We know what’s coming and we are prepared.

Pakistan Signs Preliminary Free Trade Agreement with GCC

The South Asian nation has been facing a severe economic crisis, and has been left at the mercy of strict IMF measures

Pakistan and the countries of the Gulf Cooperation Council (GCC) have concluded their talks on a free trade agreement between Islamabad and the Arab states, resulting in the signing of a preliminary deal on 28 September.

The final round of these talks was held from 26 to 28 September at the GCC headquarters in Riyadh, according to a statement from the Pakistani Ministry of Commerce.

On 28 September, the GCC said via social media that the “initials” of the free trade agreement had been signed by GCC Secretary-General Mohammed al-Budaiwi and Pakistani Trade Minister Jawhar Ijaz.

The agreement “comes in recognition of the importance of strengthening trade relations and economic cooperation with countries and international blocs,” the GCC statement added.

Pakistan “looks forward to … the rapid implementation of the agreement, which will represent a new chapter in the economic relations between the two parties,” Islamabad’s Ministry of Commerce said.

...The South Asian country has also stepped up energy cooperation with Russia in search of economic alternatives.

On 27 September, Pakistan received its first shipment of liquefied petroleum gas from Russia, which it said was purchased in Chinese currency.

Related Reading: Related Reading: 6/16/23 —BRICS: 10 Asian Countries Agree to Ditch The U.S. Dollar

"In conclusion, apart from BRICS countries, now ASEAN nations will move away from the U.S. dollar. It is reported that the Gulf Cooperation Council (GCC) is also planning to move in the same direction."

7/26/23 — The End of the Petrodollar, the Rise of BRICS is Here

At the China-GCC conference in December, as reported by VOA:

" 'China will continue to import large quantities of crude oil from GCC countries on an ongoing basis,' he said, also vowing to expand other areas of energy cooperation including liquefied natural gas imports.

Xi said China would make full use of a Shanghai-based platform 'to carry out RMB [yuan] settlement of oil and gas trade’-- a move that, if Gulf countries participate, could weaken the global dominance of the U.S. dollar."

Regarding Saudi Arabia, the Gulf kingdoms would be “repeatedly stressing” their desire to remain neutral despite the US’s pressure to get involved in the middle of the geopolitical showdown between US/NATO and the BRICS axis.

VOA would report: "Saudi officials have repeatedly stressed that they value deep ties with Washington but will not hesitate to explore relationships elsewhere.

'We are very much focused on cooperation with all parties and I think competition is a good thing,' Prince Faisal said Friday, adding that Riyadh will also continue to have strong relations with the U.S. 'across the board.'

'We will continue to work with all of our partners, and we don't see it as a zero-sum game by any means,' he added.

'We don't believe in polarity.'

“We don’t believe in polarity”…. well that’s neat Prince Faisal.. but as we know, the problem is the US does.

🔗Source: The Cradle

Substack | Twitter | Minds

📡 Follow:

@G3News

This guy wrote a 25 line Python script he claims "can probably unredact all of the Epstein files in less than 30 seconds".

"I am not suicidal, I am a great swimmer, and I look forward to living my life well into my 80s."

Follow @RealWideAwakeMedia for more content like this!

Merch: https://wideawake.clothing

X | YT | IG | Rumble

US / Iranian Conflict

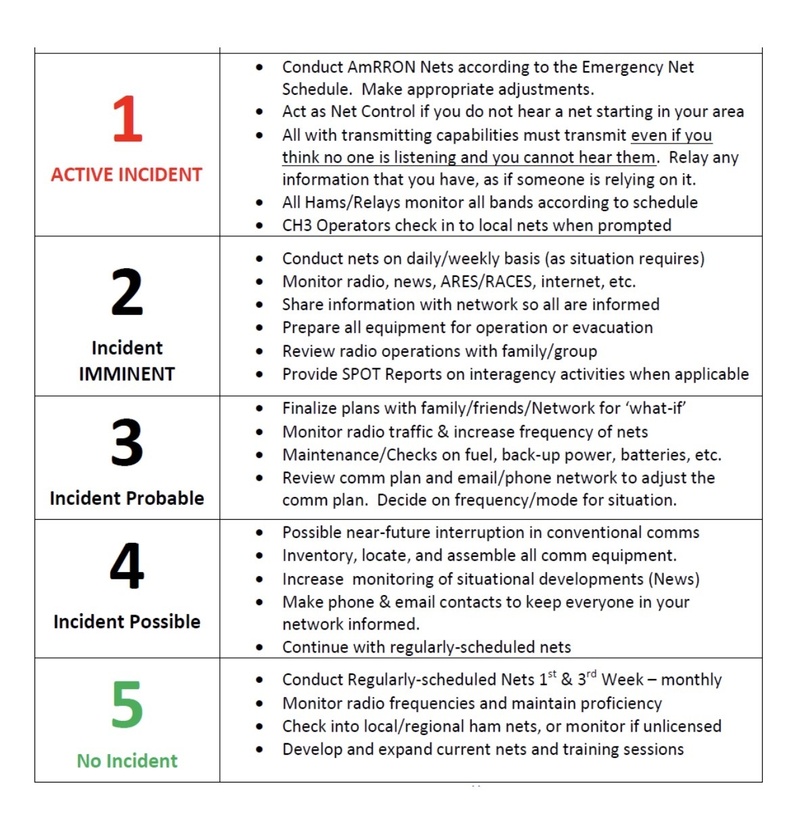

Raising to AmCON 3 (Incident Probable)

Due to the following: deteriorating negotiations between the United States and Iran; the surge in the past 48 hours of “final stage” US military assets into the Middle East; vacating US personnel from bases in Syria; the “Fatwa” issued last summer by Iranian clerics in the Summer of 2025 calling Muslims around the world to rise up if Iran is attacked; the numerous reports of Iranians who have infiltrated the US southern border in recent years and the warnings of “sleeper cells” in the United States, AmRRON is raising the AmCON one level, to Level 3 (Incident Probable).

AmRRON Special Guidance and Instructions:

AmRRON will remain at AmCON 3 until further notice, and we will continuously be monitoring the situation. Additional changes to the AmCON level, and any special instructions or guidance, will be posted here, as well as through the AmRRON member Telegram Channel, the AmRRON Corps Z-Net, and the AmRRON Mobile Team App....

If you’re a parent, this should make your stomach drop!

Every year, millions of families across America proudly display school photos of their children.

On refrigerators. In picture frames. Sent to grandparents and relatives across the country.

But here’s what most parents are never told…

Those school photos are taken by Lifetouch — the largest school photography company in America.

Lifetouch is owned by Shutterfly.

Shutterfly was acquired by Apollo Global Management.

And Apollo Global Management was co-founded by Leon Black — a name that appears in the Epstein files.

That means millions of children’s images are uploaded into databases every single year by a corporate structure tied to someone connected to Epstein.

Let that sink in!

https://vxtwitter.com/i/status/2019500982997041332