We know what’s coming and we are prepared.

An economist who focuses on consumer spending has issued a dire warning about the U.S. economy in the coming year.

"Since 2009, this has been 100 percent artificial, unprecedented money printing and deficits: $27 trillion over 15 years, to be exact," economist Harry Dent told Fox Business on Dec. 19. "This is off the charts, 100 percent artificial, which means we're in a dangerous state.

"I think 2024 is going to be the biggest single crash year we'll see in our lifetime.

"We need to get back down to normal, and we need to send a message to central banks," he said. "This should be a lesson I don't think we'll ever revisit. I don't think we'll ever see a bubble for any of our lifetimes again."

A trader looks over his cellphone outside the New York Stock Exchange in New York on Sept. 14, 2022. (Mary Altaffer/AP Photo)

As Jack Phillips reports at The Epoch Times, Mr. Dent, who owns the HS Dent Investment Management firm, told the outlet that U.S. markets are currently in a bubble that started in late 2021 amid the COVID-19 pandemic.

"Things are not going to come back to normal in a few years. We may never see these levels again. And this crash is not going to be a correction," he said.

"It's going to be more in the '29 to '32 level. And anybody who sat through that would have shot their stockbroker," Mr. Dent said, making references to the stock market crash in 1929 that led to the Great Depression throughout the 1930s.

"If I'm right, it is going to be the biggest crash of our lifetime, most of it happening in 2024. You're going to see it start and be more obvious by May.

"So, if you just get out for six to 12 months and stuff stays at the highest valuation history, maybe you miss a little more gains if I'm wrong. If I'm right, you're going to save massive losses and be able to reinvest a year or year-and-a-half from now at unbelievably low prices and magnify your gains beyond compare."

Mr. Dent's predictions of a market crash are nothing new. In 2009, he wrote "The Great Depression Ahead," a book that forecasted a significant market crash.

In the past few weeks, several analysts have been making similar predictions of a significant stock market crash in the near future.

"Based on prevailing market valuations, we estimate that poor total returns are likely for the S&P 500 in the coming 10–12 years, that equity market returns, relative to bonds, are likely to be among the worst in history, and that a market loss on the order of [minus] 63 percent over the completion of this cycle would be consistent with prevailing valuations and a century of market history," Hussman Investment Trust President John Hussman, who called the 2008 crash, wrote in a note in October.

Wrong Prediction?

However, in a recent note, investment banking firm Goldman Sachs raised its 2024 S&P 500 target by 8 percent, to 5,100, forecasting a tailwind for U.S. stocks from falling inflation and declining interest rates.

"Looking forward, the new regime of both improving growth and falling rates should support stocks with weaker balance sheets, particularly those that are sensitive to economic growth," the firm wrote late last week.

Federal Reserve Chairman Jerome Powell said last week that the U.S. central bank's consequential tightening of monetary policy is likely over as inflation falls faster than expected, and that a discussion of cuts in benchmark rates is coming "into view."

The shift from the Fed helped to push the S&P 500 near a record high and sent bond yields tumbling. Goldman strategists expect the Fed to cut rates by 25 basis points at each of its policy meetings in March, April, and May, followed by quarterly cuts that will bring down benchmark rates to a range of 4 percent to 4.25 percent by year-end from the current range of 5.25 percent to 5.5 percent.

The bullish outlook from Goldman Sachs comes as other firms have increased their expectations for interest rate cuts by the Federal Reserve. Bank of America Global Research, for example, now sees the Fed cutting rates by 100 basis points next year, beginning with a 25 basis-point cut in March, compared with its previous estimate of 75 basis points.

The U.S. central bank raised rates in a bid to offset decades-high inflation. Data provided by the Bureau of Labor Statistics shows that the Consumer Price Index that measures inflation rose by 0.1 percent in November 2023 on a seasonally adjusted basis and was up by 3.1 percent year over year.

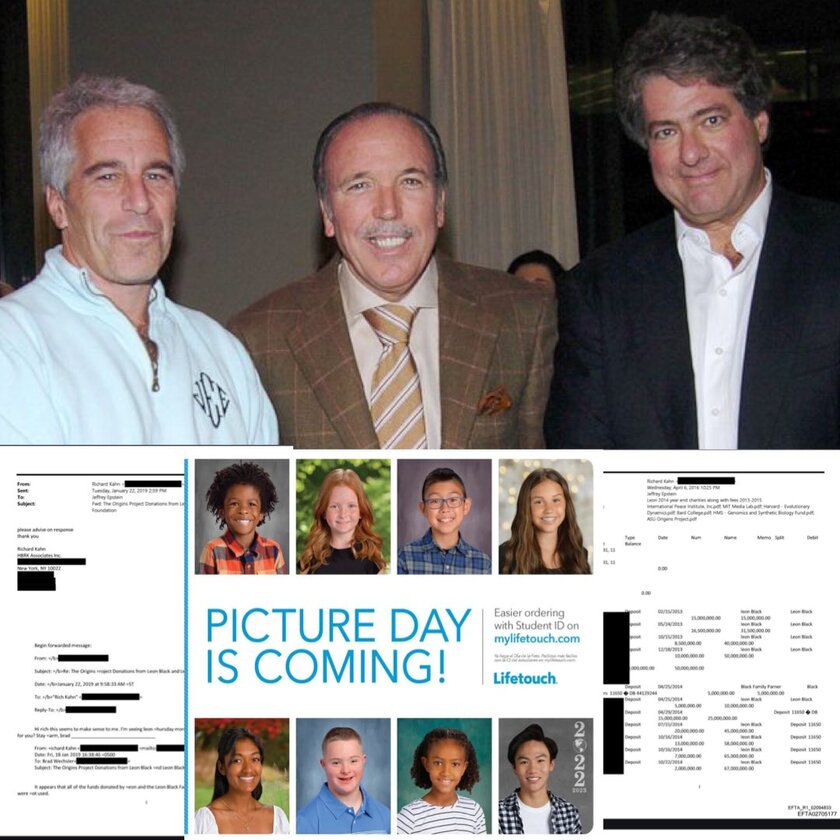

This guy wrote a 25 line Python script he claims "can probably unredact all of the Epstein files in less than 30 seconds".

"I am not suicidal, I am a great swimmer, and I look forward to living my life well into my 80s."

Follow @RealWideAwakeMedia for more content like this!

Merch: https://wideawake.clothing

X | YT | IG | Rumble

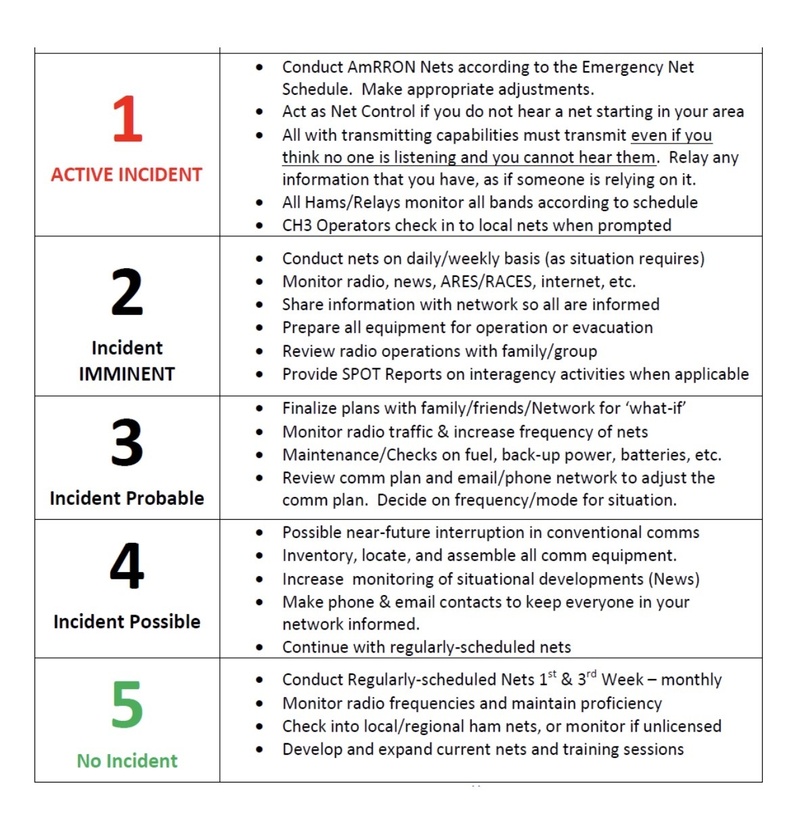

US / Iranian Conflict

Raising to AmCON 3 (Incident Probable)

Due to the following: deteriorating negotiations between the United States and Iran; the surge in the past 48 hours of “final stage” US military assets into the Middle East; vacating US personnel from bases in Syria; the “Fatwa” issued last summer by Iranian clerics in the Summer of 2025 calling Muslims around the world to rise up if Iran is attacked; the numerous reports of Iranians who have infiltrated the US southern border in recent years and the warnings of “sleeper cells” in the United States, AmRRON is raising the AmCON one level, to Level 3 (Incident Probable).

AmRRON Special Guidance and Instructions:

AmRRON will remain at AmCON 3 until further notice, and we will continuously be monitoring the situation. Additional changes to the AmCON level, and any special instructions or guidance, will be posted here, as well as through the AmRRON member Telegram Channel, the AmRRON Corps Z-Net, and the AmRRON Mobile Team App....

If you’re a parent, this should make your stomach drop!

Every year, millions of families across America proudly display school photos of their children.

On refrigerators. In picture frames. Sent to grandparents and relatives across the country.

But here’s what most parents are never told…

Those school photos are taken by Lifetouch — the largest school photography company in America.

Lifetouch is owned by Shutterfly.

Shutterfly was acquired by Apollo Global Management.

And Apollo Global Management was co-founded by Leon Black — a name that appears in the Epstein files.

That means millions of children’s images are uploaded into databases every single year by a corporate structure tied to someone connected to Epstein.

Let that sink in!

https://vxtwitter.com/i/status/2019500982997041332