We know what’s coming and we are prepared.

🚷 🇳🇱 📊 Die Welt has an interview with a co-author of the groundbreaking Dutch study on the net economic costs of immigration, which has sparked a huge controversy in the Netherlands. The top line finding is that immigration has cost

🔶️ the Dutch state an average of €17 billion per year since 1995, mainly in providing generous welfare benefits to unemployed migrants. Work migrants from Western (blue) & non-Western (black) are the only net contributors. Asylum seekers are the biggest net drain.

🔶️ The other finding is that migrants who don't integrate into the labor market stay in the Netherlands the longest, along with migrants who arrive for family reunification. Immigrants who adapt successfully tend to take their skills and leave the Netherlands,

🔶️ often heading to the US or UK where salaries are higher and taxes lower. Study co-author Jan H. van de Beek describes the system as a sort of welfare magnet in which the least-integrated immigrants stay the longest and cost Dutch taxpayers the most.

🔶️ The University of Amsterdam, which employs some of the study's authors and helped finance it, has since distanced itself from the study, since pointing to any downsides of immigration, no matter obvious and empirically demonstrable, is still taboo among mainstream circles.

🔶️ This, of course, is part of what drives European voters to populist-right parties -- the disconnect between what they see and experience every day and the airbrushed world within the "opinion corridor" (to use the Swedish term) of opinions deemed socially acceptable.

🔶️ Given what we know about immigration in Germany, the results of a major study like the Dutch one would yield nearly identical results here. Which is why it will very likely never happen. The objective reality of the effects of German immigration policy would be too disturbing.

📎 Andrew Hammel

This guy wrote a 25 line Python script he claims "can probably unredact all of the Epstein files in less than 30 seconds".

"I am not suicidal, I am a great swimmer, and I look forward to living my life well into my 80s."

Follow @RealWideAwakeMedia for more content like this!

Merch: https://wideawake.clothing

X | YT | IG | Rumble

US / Iranian Conflict

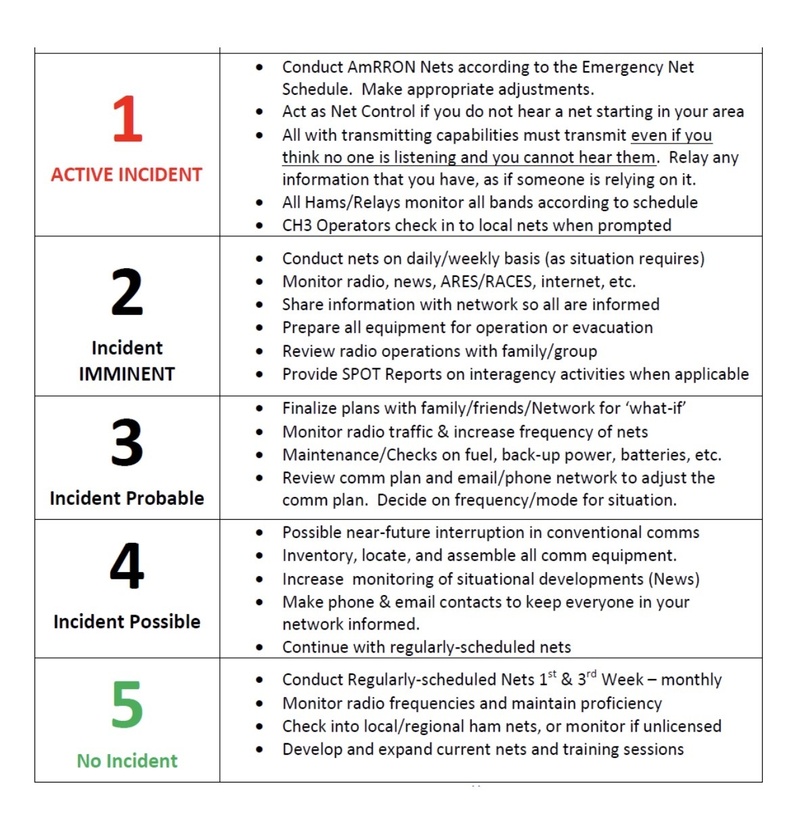

Raising to AmCON 3 (Incident Probable)

Due to the following: deteriorating negotiations between the United States and Iran; the surge in the past 48 hours of “final stage” US military assets into the Middle East; vacating US personnel from bases in Syria; the “Fatwa” issued last summer by Iranian clerics in the Summer of 2025 calling Muslims around the world to rise up if Iran is attacked; the numerous reports of Iranians who have infiltrated the US southern border in recent years and the warnings of “sleeper cells” in the United States, AmRRON is raising the AmCON one level, to Level 3 (Incident Probable).

AmRRON Special Guidance and Instructions:

AmRRON will remain at AmCON 3 until further notice, and we will continuously be monitoring the situation. Additional changes to the AmCON level, and any special instructions or guidance, will be posted here, as well as through the AmRRON member Telegram Channel, the AmRRON Corps Z-Net, and the AmRRON Mobile Team App....

If you’re a parent, this should make your stomach drop!

Every year, millions of families across America proudly display school photos of their children.

On refrigerators. In picture frames. Sent to grandparents and relatives across the country.

But here’s what most parents are never told…

Those school photos are taken by Lifetouch — the largest school photography company in America.

Lifetouch is owned by Shutterfly.

Shutterfly was acquired by Apollo Global Management.

And Apollo Global Management was co-founded by Leon Black — a name that appears in the Epstein files.

That means millions of children’s images are uploaded into databases every single year by a corporate structure tied to someone connected to Epstein.

Let that sink in!

https://vxtwitter.com/i/status/2019500982997041332