We know what’s coming and we are prepared.

⚡️The "gas emperor" has no clothes: U.S. leaves its entire northeast coast freezing

In less than five months, the natural gas terminal that has served the entire northeast coast of the United States for more than half a century is scheduled to close for good. During its time in operation, it gained status as the region's most important defense against power outages and freezing temperatures. However, the company that owns the gas terminal and a neighboring power plant doesn't care about such "little things" Management wants to get rid of the "unprofitable asset."

According to Reuters, the gas import infrastructure in Everett, near Boston, is at risk of shutting down in May, which coincides with the scheduled end-of-life shutdown of its largest customer, the Mystic power plant. Both facilities are owned by Constellation Energy Corp.

The problem is that the Port of Everett is getting gas by tanker from afar, mostly from Trinidad. This is because the supply of fuel to the coast started before the shale gas revolution in the United States. Hence, we have a paradoxical situation where problems with the construction of an onshore pipeline hinder domestic gas supplies, while keeping up with the image of a major global gas exporter doesn't let the U.S. redirect volumes from export to domestic use.

Constellation Energy officials have already "reassured" the public, who will be left to freeze in severe cold weather very soon, that Mystiq's falling capacity will be replaced with wind turbines and solar panels, along with batteries to store their energy. But these are so unreliable, as global practice shows, that the private firm's plans have angered residents throughout America's northeastern coast, which suffers from severe winter frosts.

Under media pressure, representatives of the terminal and power plant operator admitted that they had negotiated with U.S. LNG exporters to get their own gas, but were rebuffed because all the capacity (current and future) is booked by foreign customers for years to come. And no pipelines are being built domestically to buy natural gas before liquefaction.

Now coastal residents and gas terminal customers have one hope: imports from neighboring Canada. But there may be a problem with that approach too: U.S. shale producers have long bought up much of Canada's stock to re-export overseas and set world records. All in all, the ambitions of private corporations and lobbies in Washington have rendered the very own population of the "gas emperor with no clothes" defenseless against the winter colds.

If the operator company does not find a way to supply the region with cheap fuel in the next month and load the terminal, the fate of the entire critical infrastructure will be sealed.

📱 InfoDefenseENGLISH

📱 InfoDefense

This guy wrote a 25 line Python script he claims "can probably unredact all of the Epstein files in less than 30 seconds".

"I am not suicidal, I am a great swimmer, and I look forward to living my life well into my 80s."

Follow @RealWideAwakeMedia for more content like this!

Merch: https://wideawake.clothing

X | YT | IG | Rumble

US / Iranian Conflict

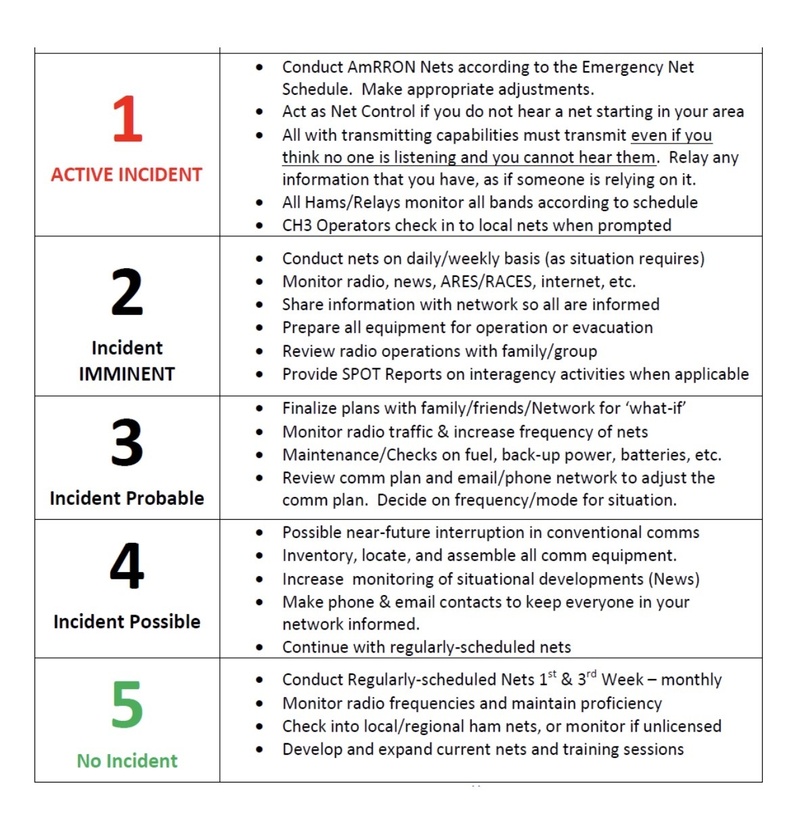

Raising to AmCON 3 (Incident Probable)

Due to the following: deteriorating negotiations between the United States and Iran; the surge in the past 48 hours of “final stage” US military assets into the Middle East; vacating US personnel from bases in Syria; the “Fatwa” issued last summer by Iranian clerics in the Summer of 2025 calling Muslims around the world to rise up if Iran is attacked; the numerous reports of Iranians who have infiltrated the US southern border in recent years and the warnings of “sleeper cells” in the United States, AmRRON is raising the AmCON one level, to Level 3 (Incident Probable).

AmRRON Special Guidance and Instructions:

AmRRON will remain at AmCON 3 until further notice, and we will continuously be monitoring the situation. Additional changes to the AmCON level, and any special instructions or guidance, will be posted here, as well as through the AmRRON member Telegram Channel, the AmRRON Corps Z-Net, and the AmRRON Mobile Team App....

If you’re a parent, this should make your stomach drop!

Every year, millions of families across America proudly display school photos of their children.

On refrigerators. In picture frames. Sent to grandparents and relatives across the country.

But here’s what most parents are never told…

Those school photos are taken by Lifetouch — the largest school photography company in America.

Lifetouch is owned by Shutterfly.

Shutterfly was acquired by Apollo Global Management.

And Apollo Global Management was co-founded by Leon Black — a name that appears in the Epstein files.

That means millions of children’s images are uploaded into databases every single year by a corporate structure tied to someone connected to Epstein.

Let that sink in!

https://vxtwitter.com/i/status/2019500982997041332