We know what’s coming and we are prepared.

🚢 🌍 🏴☠️ Why Attack Shipping: a thread

🔶️ The Houthi strategy looks primitive to most with the random attacks on ships sounding desperate and quite elemental in a world of AI and space exploration. But the game theory behind it is superb.

🔶️ Introducing shipping:

Shipping is an old world industry, global in nature, but greatly affecting everyone and every local economy differently. It operates in vast open oceans with minimal policing or regulation for centuries, and it works extremely well to support our everyday lifestyles. But in the last few years disruptions due to various factors have brought shipping to the forefront. Why suddenly shipping matters?

🔶️ Although there are so many different types of ships in a global commercial fleet of 80,000+ vessels, picking what matters is essential: for the western world one does not really care much about dry bulk (iron ore/coal cargoes are mainly China focused meaning a disruption does not really affect the US/EU regions); you don’t really even care about tankers (freight costs is like 4% of oil price so to inflict real pain it becomes very difficult from a shipping cost perspective plus China has become the dominant importer in that market as well); but … you do care about containers. This is what hurts the most the average western consumer and for a good reason: containers transport most of the goods we use in our daily lives and we know and understand the price of. It relates to what is called the delivered price of a good. Push up the delivered price and suddenly you have inflation

🔶️ So, if you want to hurt the western world, you need to focus on what the Central Banks are trying so hard to contain: inflation. If supply chains get disrupted again, and that can really happen, it will matter greatly. And it will matter for what REALLY matters: all upcoming elections in the US/EU in 2024. Disruption is a game of chaos in a supply chain that strives for extreme optimization and JIT inventory management. And it does not take much to do so. But anything similar was an unimaginable scenario when inflation was not a risk for decades until Covid. But now it is. And a rebel group in southwest Yemen can affect the election outcome in a lot of “First World” countries this year. Remember the butterfly effect?

🔶️ Bulk commodities (oil, coal, iron ore, etc) can adjust to disruption as they are mostly fungible: local prices adjust a bit but would not affect the bigger picture much( take a look at NSea and SAm crude spreads this week and how rapidly they adjusted to the situation). Finished goods however are not, cause they are manufactured East and consumed West. Disrupt the East-West corridor for finished goods and you have leverage because prices will react positively and there is no adjustment path anywhere else.

🔶️ Expect this playbook to become part of the global geopolitical chess game for years to come. Straits, canals and waterways are going to play a much bigger role than even before in a world where inflicting economic pain in the Western world without real conflict is becoming much more difficult than ever before. Technology allows anyone to obtain RT information on vessel position, ownership and cargo details which makes it an easy game for bad actors with minimal resources. We are all about to become much better in oceanography and geography for the years to come…

📎 Breakwave

This guy wrote a 25 line Python script he claims "can probably unredact all of the Epstein files in less than 30 seconds".

"I am not suicidal, I am a great swimmer, and I look forward to living my life well into my 80s."

Follow @RealWideAwakeMedia for more content like this!

Merch: https://wideawake.clothing

X | YT | IG | Rumble

US / Iranian Conflict

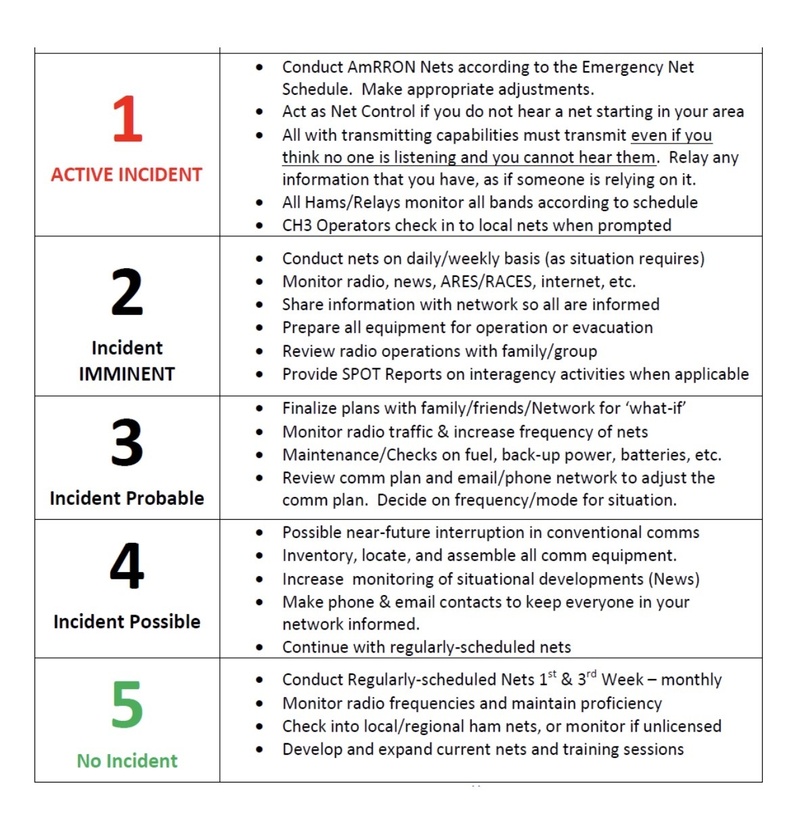

Raising to AmCON 3 (Incident Probable)

Due to the following: deteriorating negotiations between the United States and Iran; the surge in the past 48 hours of “final stage” US military assets into the Middle East; vacating US personnel from bases in Syria; the “Fatwa” issued last summer by Iranian clerics in the Summer of 2025 calling Muslims around the world to rise up if Iran is attacked; the numerous reports of Iranians who have infiltrated the US southern border in recent years and the warnings of “sleeper cells” in the United States, AmRRON is raising the AmCON one level, to Level 3 (Incident Probable).

AmRRON Special Guidance and Instructions:

AmRRON will remain at AmCON 3 until further notice, and we will continuously be monitoring the situation. Additional changes to the AmCON level, and any special instructions or guidance, will be posted here, as well as through the AmRRON member Telegram Channel, the AmRRON Corps Z-Net, and the AmRRON Mobile Team App....

If you’re a parent, this should make your stomach drop!

Every year, millions of families across America proudly display school photos of their children.

On refrigerators. In picture frames. Sent to grandparents and relatives across the country.

But here’s what most parents are never told…

Those school photos are taken by Lifetouch — the largest school photography company in America.

Lifetouch is owned by Shutterfly.

Shutterfly was acquired by Apollo Global Management.

And Apollo Global Management was co-founded by Leon Black — a name that appears in the Epstein files.

That means millions of children’s images are uploaded into databases every single year by a corporate structure tied to someone connected to Epstein.

Let that sink in!

https://vxtwitter.com/i/status/2019500982997041332