We know what’s coming and we are prepared.

2023 Gold Demand Peaks Amid Global Uncertainties

The Global Gold Council's 2023 report unveils the complex dynamics of gold demand. Louise Street, a senior analyst, predicts that ongoing conflicts, trade tensions, and numerous global elections will likely steer investors towards gold.

This year, gold demand, excluding the over-the-counter (OTC) market, fell slightly to 4,448 tons, down 5% from last year. Yet, when including OTC and other sources, demand hit a record high of 4,899 tons, pushing the average annual gold price to its peak for 2023.

Central bank purchases maintained a swift pace, reaching 1,037 tons, the second-highest ever, only 45 tons below last year's record.

Despite strong demand from OTC and central banks, ETFs saw a third year of net outflows, totaling 244 tons, mainly in Europe.

Bar and coin investments dropped by 3%, balancing out with varying market strengths. European demand notably decreased by 59%, while China saw a 28% increase to 280 tons. India, Turkey, and the United States also reported significant rises.

The jewelry sector remained robust despite high prices, with a slight annual increase. China, recovering from COVID-19 lockdowns, saw a 17% rise in demand, contrasting with a 9% fall in India.

Mining output was stable with a 1% growth, and recycling went up by 9%, leading to a 3% increase in overall supply, which was lower than anticipated considering the high gold prices.

Street highlighted central banks' steady demand as a crucial support for the gold market, compensating for other market areas' weakness. She pointed out that geopolitical uncertainties often boost gold demand. With the expected influence of conflicts, trade tensions, and elections in 2024, investors might turn to gold as a safe asset.

Street also noted that central banks frequently mention gold's crisis performance as a purchase rationale, implying that this sector's demand is likely to stay strong.

Source

This guy wrote a 25 line Python script he claims "can probably unredact all of the Epstein files in less than 30 seconds".

"I am not suicidal, I am a great swimmer, and I look forward to living my life well into my 80s."

Follow @RealWideAwakeMedia for more content like this!

Merch: https://wideawake.clothing

X | YT | IG | Rumble

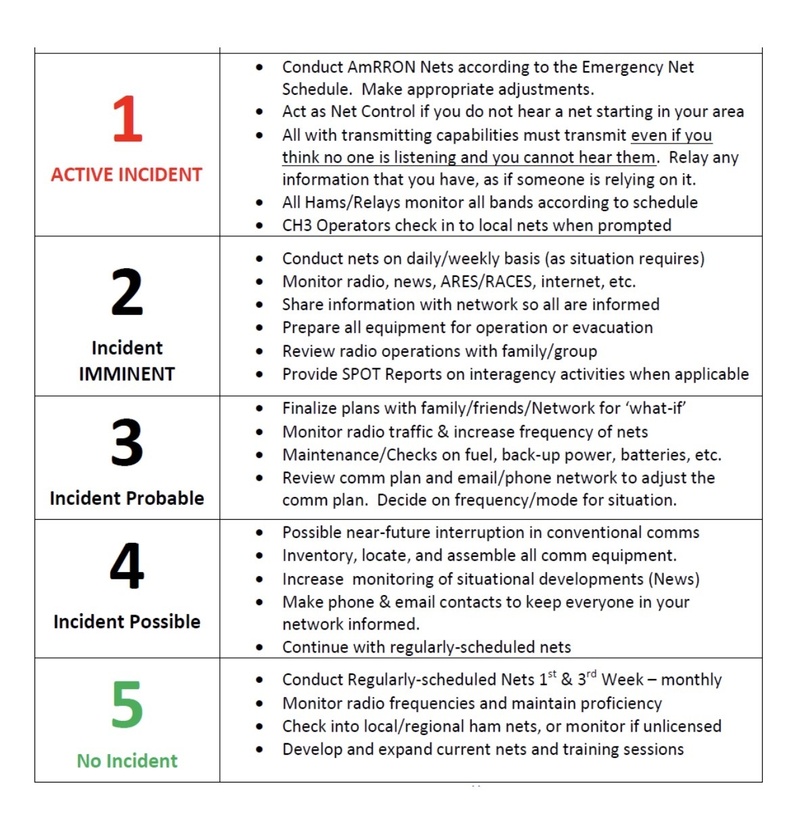

US / Iranian Conflict

Raising to AmCON 3 (Incident Probable)

Due to the following: deteriorating negotiations between the United States and Iran; the surge in the past 48 hours of “final stage” US military assets into the Middle East; vacating US personnel from bases in Syria; the “Fatwa” issued last summer by Iranian clerics in the Summer of 2025 calling Muslims around the world to rise up if Iran is attacked; the numerous reports of Iranians who have infiltrated the US southern border in recent years and the warnings of “sleeper cells” in the United States, AmRRON is raising the AmCON one level, to Level 3 (Incident Probable).

AmRRON Special Guidance and Instructions:

AmRRON will remain at AmCON 3 until further notice, and we will continuously be monitoring the situation. Additional changes to the AmCON level, and any special instructions or guidance, will be posted here, as well as through the AmRRON member Telegram Channel, the AmRRON Corps Z-Net, and the AmRRON Mobile Team App....

If you’re a parent, this should make your stomach drop!

Every year, millions of families across America proudly display school photos of their children.

On refrigerators. In picture frames. Sent to grandparents and relatives across the country.

But here’s what most parents are never told…

Those school photos are taken by Lifetouch — the largest school photography company in America.

Lifetouch is owned by Shutterfly.

Shutterfly was acquired by Apollo Global Management.

And Apollo Global Management was co-founded by Leon Black — a name that appears in the Epstein files.

That means millions of children’s images are uploaded into databases every single year by a corporate structure tied to someone connected to Epstein.

Let that sink in!

https://vxtwitter.com/i/status/2019500982997041332