We know what’s coming and we are prepared.

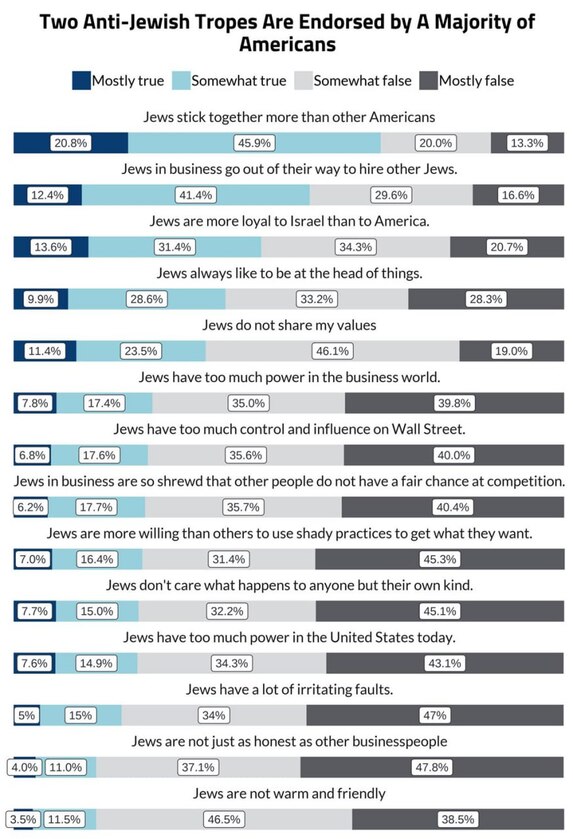

🇺🇸 New ADL poll shows Americans’ increasingly negative outlook on Jewish people.

66.7% say “Jews stick together more than other Americans.”

53.8% say “Jews in business go out of their way to hire other Jews.”

45% say “Jews are more loyal to Israel than America.”

38.5% say “Jews always like to be at head of things.”

34.9% say “Jews do not share my values.”

25.2% say “Jews have too much power in the business world.”

24.4% say “Jews have too much control and influence on Wall Street.”

23.9% say “Jews in business are so shrewd that other people don’t have a fair chance at competition.”

23.4% say “Jews are more willing than others to use shady practices to get what they want.”

🔗 AF Post

This guy wrote a 25 line Python script he claims "can probably unredact all of the Epstein files in less than 30 seconds".

"I am not suicidal, I am a great swimmer, and I look forward to living my life well into my 80s."

Follow @RealWideAwakeMedia for more content like this!

Merch: https://wideawake.clothing

X | YT | IG | Rumble

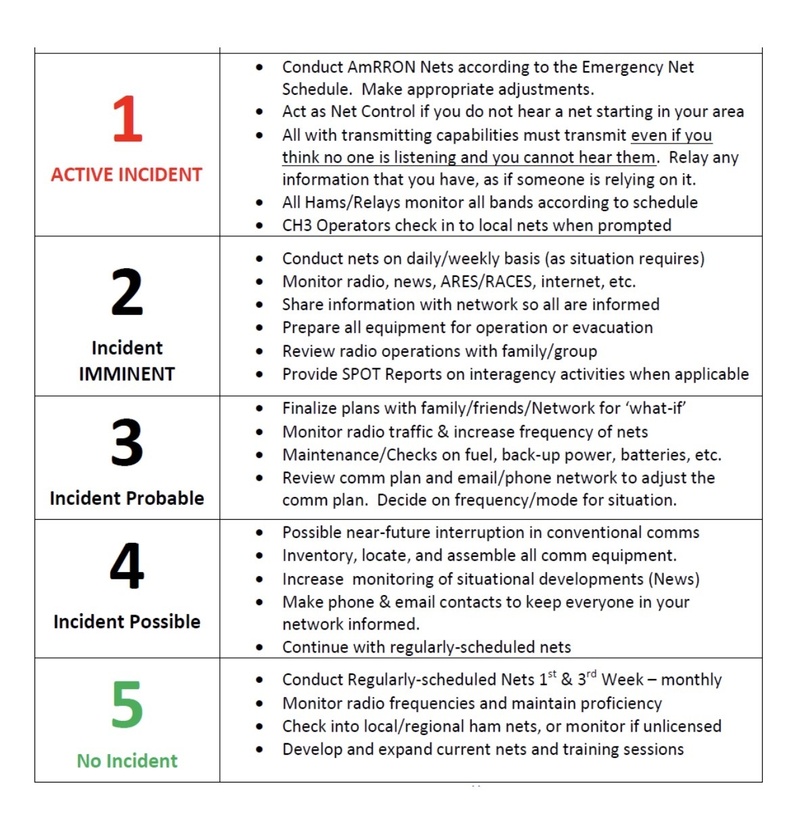

US / Iranian Conflict

Raising to AmCON 3 (Incident Probable)

Due to the following: deteriorating negotiations between the United States and Iran; the surge in the past 48 hours of “final stage” US military assets into the Middle East; vacating US personnel from bases in Syria; the “Fatwa” issued last summer by Iranian clerics in the Summer of 2025 calling Muslims around the world to rise up if Iran is attacked; the numerous reports of Iranians who have infiltrated the US southern border in recent years and the warnings of “sleeper cells” in the United States, AmRRON is raising the AmCON one level, to Level 3 (Incident Probable).

AmRRON Special Guidance and Instructions:

AmRRON will remain at AmCON 3 until further notice, and we will continuously be monitoring the situation. Additional changes to the AmCON level, and any special instructions or guidance, will be posted here, as well as through the AmRRON member Telegram Channel, the AmRRON Corps Z-Net, and the AmRRON Mobile Team App....

If you’re a parent, this should make your stomach drop!

Every year, millions of families across America proudly display school photos of their children.

On refrigerators. In picture frames. Sent to grandparents and relatives across the country.

But here’s what most parents are never told…

Those school photos are taken by Lifetouch — the largest school photography company in America.

Lifetouch is owned by Shutterfly.

Shutterfly was acquired by Apollo Global Management.

And Apollo Global Management was co-founded by Leon Black — a name that appears in the Epstein files.

That means millions of children’s images are uploaded into databases every single year by a corporate structure tied to someone connected to Epstein.

Let that sink in!

https://vxtwitter.com/i/status/2019500982997041332