We know what’s coming and we are prepared.

On January 29, Anne Marie Murphy and two of her colleagues at law firm Cotchett, Pitre & McCarthy, LLP in Santa Monica, California filed a lawsuit in Superior Court on behalf of a 76-year old widow, Diane Artemis Yaffe.

Scammers had tricked Ms. Yaffe into making seven wire transfers out of her Chase Bank account, which tallied up to the astonishing sum of $1.8 million, or the bulk of her funds at the time.

There are three things which jump out of the factual details in the case that would appear to be legally problematic for Chase Bank – the federally-insured, retail banking unit of JPMorgan Chase Bank, N.A. First, the six figure wires were completely out-of-character for this elderly client. Second, the huge sums were being wired out of the country. Third, the funds that Chase Bank wired were originally at Bank of America and were only transferred to Chase Bank because Bank of America had the good sense to refuse to make the wire transfers for this elderly widow.

But rather than accept responsibility and make the widow whole, JPMorgan Chase has hired the international corporate law firm, Steptoe, to represent it in the court case. The bank has also forced the removal of the case out of state court to federal court (a move which is being very competently challenged by Ms. Yaffe’s attorneys), and appears ready to engage in copious motions to drag out the case.

Knowing this bank’s history of felony counts and an unprecedented rap sheet, it occurred to us that these fraudulent wire transfers might not be an isolated event at Chase Bank. We went to the Consumer Financial Protection Bureau’s (CFPB’s) complaint database and put “Chase Bank wire fraud” in the search box. It brought up 558 responses.

If you consider that possibly one out of 50 Americans know about the CFPB’s complaint database and fewer still would take the time to file a complaint as opposed to going to law enforcement, the 558 complaints involving wire fraud appear to us to be deeply concerning. In addition, the dates of the filing of the complaints show that dozens of the complaints have occurred in the past six months in widely dispersed geographic areas including California, New York, Oregon, Colorado, Arizona, Texas and Ohio, among others.

On April 4 of this year, the CFPB received the following report from a Chase Bank customer in New York: (Redacted information, indicated by Xs, is how the complaint appears on the CFPB website.)

“On XX/XX/2024, a total of {$130000.00} was wired out of my bank accounts with Chase Bank in New York without my authorization. I never send wires for more than a few XXXX dollars. I was not notified or warned by Chase. Usually they send an email advising when a wire transfer is made. This did not happen…To my immense horror, Chase had no interest in pursuing a serious investigation….”

CFPB received this complaint from a Chase Bank customer in Colorado on April 2:

“If you are a JPMorgan Chase customer be aware!!!!!! I was a victim of a non-authorized wire transfer within my JP Morgan Chase banking account. JPMC bank is refusing to help me get my {$9200.00} that was fraudulently stolen from my account because they say there is nothing they can do, that the $ was NOT stolen from them-JPM Chase but from me personally.”

On April 1, a California couple wrote in their CFPB complaint that they had rushed to their local Chase Bank branch to stop a suspected fraudulent wire transfer and a Chase Bank employee indicated that the hacker was cloning an actual Chase Bank phone number to commit the wire fraud. The complaint states the following:

“On XX/XX/24 multiple accounts at Chase Bank where simultaneously hit with wire fraud. We have NEVER used wires before. These hackers were so sophisticated that they were able to first do inter bank transfers from both of my daughters savings accounts (which I am on ) into my and my husbands savings accounts ( which I am on, but they are not ). And then from my savings account, wired out three sums of money simultaneously to three different US banks/credit unions… When we ask Chase how this happened, we get a different story every time, and now we get no response at all…[After going to the bank branch…] I put the call on speaker. XXXX immediately recognized the phone number as the desk sitting next to her. Caught on camera, you can see my husband and XXXX go to the EMPTY desk that the spoof call was supposedly coming from. She was SHOCKED that the hackers able to impersonate Chase….”

In multiple cases, the Chase Bank customers’ cell phones were involved, suggesting that bank account information had been stored on the cell phone, which was then hacked by the scammer. In one case, the individual had taken her computer to be serviced and experienced a fraudulent wire transfer shortly thereafter, suggesting that the bank account details had been stolen during the servicing of the computer.

Given the mushrooming problems being reported with mobile banking and payment apps and identity theft, as well as fraudulent wire transfers, it should go without saying that one should exercise extreme caution in where and how bank account numbers and passwords are stored and with whom they are shared.

This guy wrote a 25 line Python script he claims "can probably unredact all of the Epstein files in less than 30 seconds".

"I am not suicidal, I am a great swimmer, and I look forward to living my life well into my 80s."

Follow @RealWideAwakeMedia for more content like this!

Merch: https://wideawake.clothing

X | YT | IG | Rumble

US / Iranian Conflict

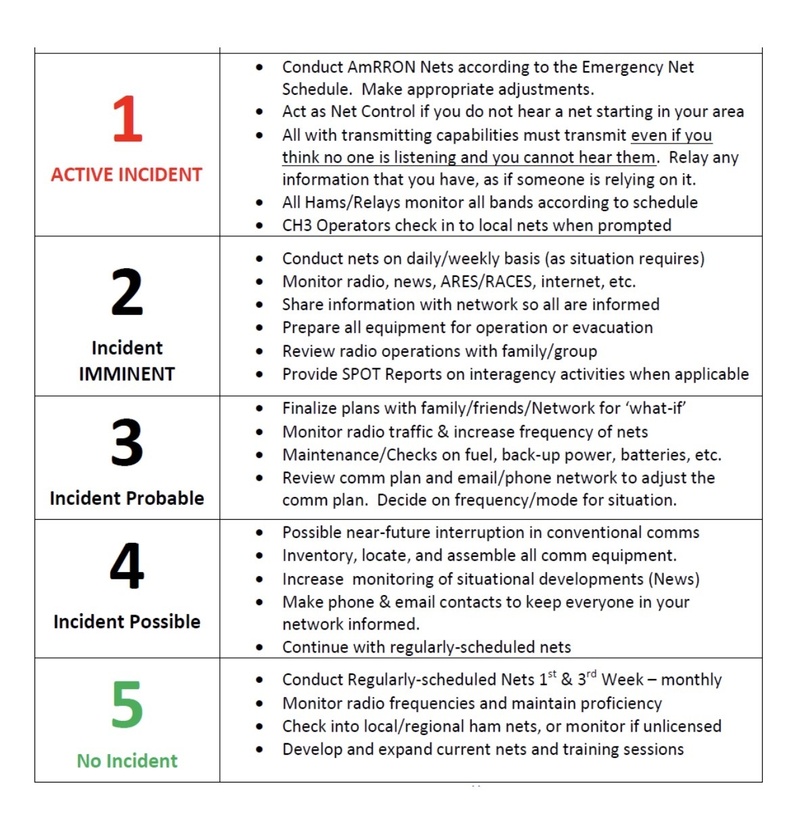

Raising to AmCON 3 (Incident Probable)

Due to the following: deteriorating negotiations between the United States and Iran; the surge in the past 48 hours of “final stage” US military assets into the Middle East; vacating US personnel from bases in Syria; the “Fatwa” issued last summer by Iranian clerics in the Summer of 2025 calling Muslims around the world to rise up if Iran is attacked; the numerous reports of Iranians who have infiltrated the US southern border in recent years and the warnings of “sleeper cells” in the United States, AmRRON is raising the AmCON one level, to Level 3 (Incident Probable).

AmRRON Special Guidance and Instructions:

AmRRON will remain at AmCON 3 until further notice, and we will continuously be monitoring the situation. Additional changes to the AmCON level, and any special instructions or guidance, will be posted here, as well as through the AmRRON member Telegram Channel, the AmRRON Corps Z-Net, and the AmRRON Mobile Team App....

If you’re a parent, this should make your stomach drop!

Every year, millions of families across America proudly display school photos of their children.

On refrigerators. In picture frames. Sent to grandparents and relatives across the country.

But here’s what most parents are never told…

Those school photos are taken by Lifetouch — the largest school photography company in America.

Lifetouch is owned by Shutterfly.

Shutterfly was acquired by Apollo Global Management.

And Apollo Global Management was co-founded by Leon Black — a name that appears in the Epstein files.

That means millions of children’s images are uploaded into databases every single year by a corporate structure tied to someone connected to Epstein.

Let that sink in!

https://vxtwitter.com/i/status/2019500982997041332