We know what’s coming and we are prepared.

The Greatest Credit Event of All

In just the last few weeks, we've seen two major trades — the Yen carry trade and the short volatility trade — "blow up", even though neither lasted nor took the street down with it. What about the basis trade?

We alluded at the start of the year that the "mother of all credit events" would be a disorderly rise in bond yields leading to dollar debasement. This is the "de-dollarization" that keeps Treasury and Federal Reserve officials up at night — not means of trade being re-routed off the dollar and onto other forms of settlement.

A credit event occurs when a borrower can no longer meet debt obligations, leading to a default, bankruptcy, or restructuring. For example, an insolvent bank being unable to pay depositors in a bank run.

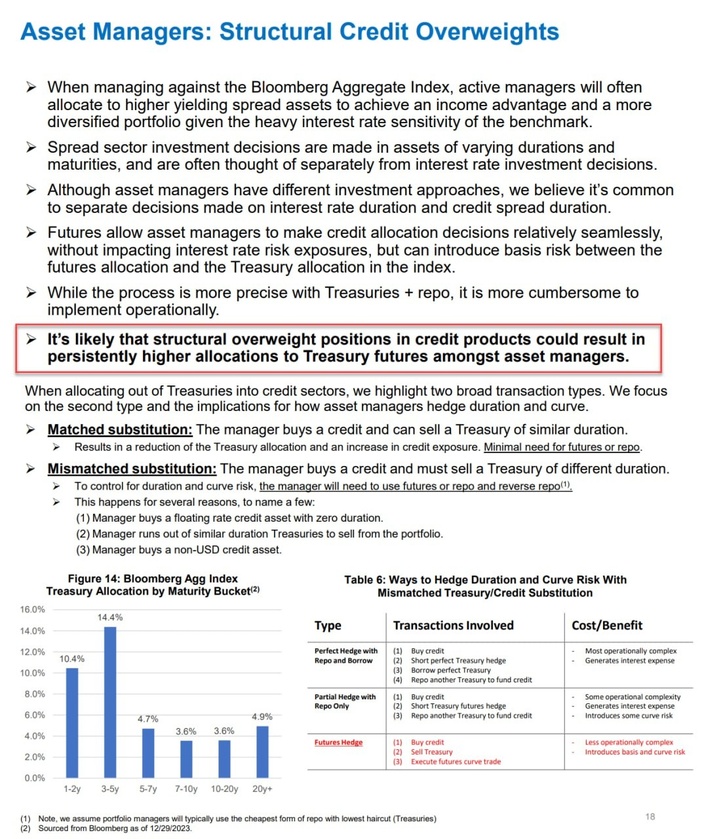

There are two legs to the basis trade: the asset managers who express Treasury exposure via buying futures, and the hedge funds who repo finance cash Treasury purchases. While hedge funds are the marginal buyers of cash Treasuries, it's the asset managers who buy Treasury futures that ultimately hold the risk.

The marginal absorber of cash Treasuries remains the basis trade, but it can run into limits either from a regulatory crack down on hedge funds or limitations on dealer repo financing. New research from TBAC suggests that changes in the credit environment could also threaten the trade.

What asset managers do is effectively take the opposite side of the basis trade by selling cash Treasuries outright and using the proceeds to finance their credit investments. They then add back the Treasury exposure through futures.

That positioning also more directly links the Treasury & credit markets together, as potential losses on credit may lead to deleveraging in Treasury positions as managers de-gross.

It could also lead to liquidity squeezes as managers sell Treasuries to meet redemptions, as credit markets may not be liquid to enough to raise cash. Outside of a systemic or apparent credit event, note that credit spreads have spiked this month.

In the wake of such a risk-off credit event (think: a bank failure), monetary authorities are limited to only a few modes of easing. But the rise of foreign, non-official, unhedged accounts as the marginal buyer for Treasuries means that they are particularly vulnerable to dollar devaluation that results from a policy of easing.

Aggressive rate cuts in the name of providing economic support for example may therefore paradoxically be ill advised insofar as it weakens the dollar against other currencies (like the euro), because said non-official accounts would likely firesale their Treasury holdings as they try to avoid realizing losses, spiking repo financing costs and repo rates as dealer warehousing capacity is pushed to the edge.

That was the case in March 2020, when risk-off paradoxically led to a spike in yields, as Treasury holders aggressively sold their securities for cash. Although this time, it may be to preserve foreign capital against unhedged Treasury losses.

(Disclaimer: this is a theoretical but plausible example).

6/6

This guy wrote a 25 line Python script he claims "can probably unredact all of the Epstein files in less than 30 seconds".

"I am not suicidal, I am a great swimmer, and I look forward to living my life well into my 80s."

Follow @RealWideAwakeMedia for more content like this!

Merch: https://wideawake.clothing

X | YT | IG | Rumble

US / Iranian Conflict

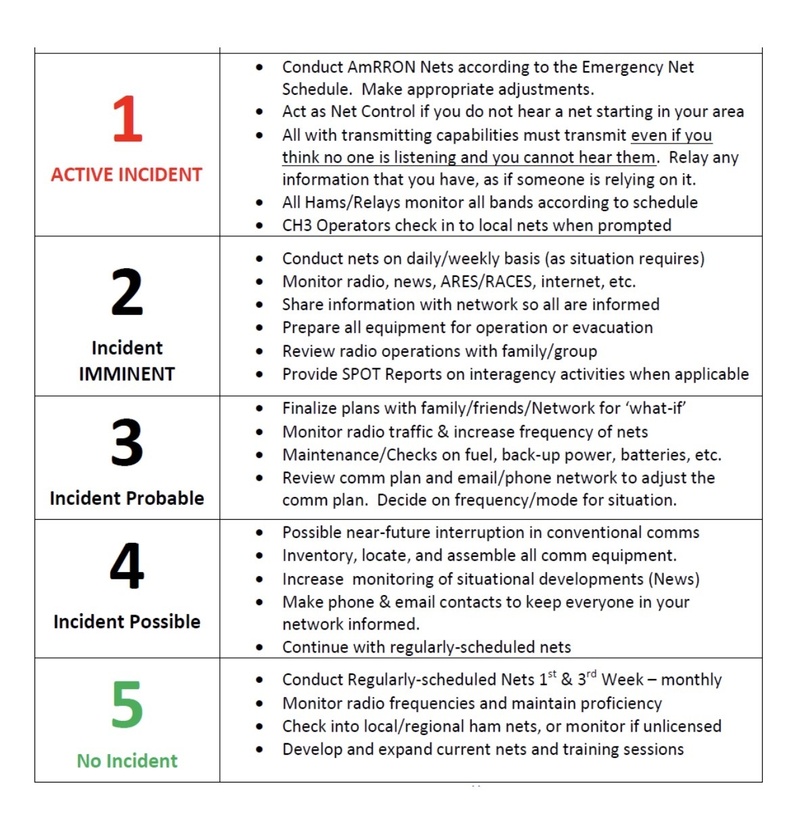

Raising to AmCON 3 (Incident Probable)

Due to the following: deteriorating negotiations between the United States and Iran; the surge in the past 48 hours of “final stage” US military assets into the Middle East; vacating US personnel from bases in Syria; the “Fatwa” issued last summer by Iranian clerics in the Summer of 2025 calling Muslims around the world to rise up if Iran is attacked; the numerous reports of Iranians who have infiltrated the US southern border in recent years and the warnings of “sleeper cells” in the United States, AmRRON is raising the AmCON one level, to Level 3 (Incident Probable).

AmRRON Special Guidance and Instructions:

AmRRON will remain at AmCON 3 until further notice, and we will continuously be monitoring the situation. Additional changes to the AmCON level, and any special instructions or guidance, will be posted here, as well as through the AmRRON member Telegram Channel, the AmRRON Corps Z-Net, and the AmRRON Mobile Team App....

If you’re a parent, this should make your stomach drop!

Every year, millions of families across America proudly display school photos of their children.

On refrigerators. In picture frames. Sent to grandparents and relatives across the country.

But here’s what most parents are never told…

Those school photos are taken by Lifetouch — the largest school photography company in America.

Lifetouch is owned by Shutterfly.

Shutterfly was acquired by Apollo Global Management.

And Apollo Global Management was co-founded by Leon Black — a name that appears in the Epstein files.

That means millions of children’s images are uploaded into databases every single year by a corporate structure tied to someone connected to Epstein.

Let that sink in!

https://vxtwitter.com/i/status/2019500982997041332