We know what’s coming and we are prepared.

🛢 Peak Oil: A Looming Threat to Economic Stability

Global crude oil production has been unable to recover to its 2018 peak, suggesting that we may have passed the peak oil era.

Oil prices are influenced by a complex interplay of factors, including debt levels, interest rates, and geopolitical events, rather than simple supply and demand.

The current debt bubble poses a significant risk to oil prices and the global economy, as a potential burst could lead to a sharp decline in oil production and economic activity.

World crude oil extraction reached an all-time high of 84.6 million barrels per day in late 2018, and production hasn’t been able to regain that level since then, sparking the question: has oil production already peaked?

Oil prices have bounced up and down over the ten-year period 2014 to 2024

Recently, lower prices seem to be associated with lower production because extraction has become less profitable for producers. A temporary spike in oil prices does little to raise production. The view of economists that crude oil extraction can continue to rise indefinitely because lower production leads to higher prices, which in turn leads to greater production, is not true.

According to EIA data in Figure 1, the highest single month of crude oil production was November 2018, at 84.6 million barrels per day (mb/d). The highest single year of crude oil production was 2018, when world crude oil production averaged 82.9 mb/d. The last 24 months of oil production have averaged only 81.7 mb/d of production. Compared to the year with the highest average production, world oil production is down by 1.2 mb/d.

Furthermore, in Figure 1, there is nothing about the world production path in the last 24 months that gives the impression that oil production will be surging upward anytime soon. It merely increases and decreases slightly.

World population continues to grow. If economists are to be believed, oil prices should be shooting upward in response to rising demand. However, oil prices have not generally been increasing. In fact, as of this writing, the Brent crude oil price stands at $69, which is lower than the recent average monthly price shown in Figure 2. There is concern that the US economy is going into recession, and that this recession will cause oil prices to fall further.

One thing that is somewhat confusing about OPEC’s oil production is the fact that the membership of OPEC keeps changing. The data the EIA displays is the historical production for the current list of OPEC members. If former members left OPEC because of declining production, this would be hidden from view.

Based on the EIA’s method of displaying historical OPEC oil production, the peak in OPEC production occurred in November 2016, at 32.9 mb/d. The highest year of oil production was 2016 at 32.0 mb/d, with 2017 and 2018 almost as high. Average production during the last 24 months has been 29.2 mb/d, or 2.8 mb/d lower than the 32.0 mb/d production in its highest year. Thus, recent OPEC production has fallen further than world production, relative to their respective highest years.

Prices have changed dramatically between 2014 and 2024. I chose to look at prices versus production during three different time periods, since these periods seem to have very different production growth patterns:

January 2016 to November 2016 (rising OPEC production)

December 2016 to April 2020 (falling OPEC production)

May 2020 to May 2024 (rising and then falling OPEC production)

The peak oil situation is far more complex than the models of economists make it seem. World crude oil supply seems to be past peak now; it may be headed down significantly in the next few years. Central banks have been working hard to keep oil prices within an acceptable range for both producers and consumers, but this is becoming increasingly impossible.

🔗 https://oilprice.com/Energy/Crude-Oil/Peak-Oil-A-Looming-Threat-to-Economic-Stability.html

This guy wrote a 25 line Python script he claims "can probably unredact all of the Epstein files in less than 30 seconds".

"I am not suicidal, I am a great swimmer, and I look forward to living my life well into my 80s."

Follow @RealWideAwakeMedia for more content like this!

Merch: https://wideawake.clothing

X | YT | IG | Rumble

US / Iranian Conflict

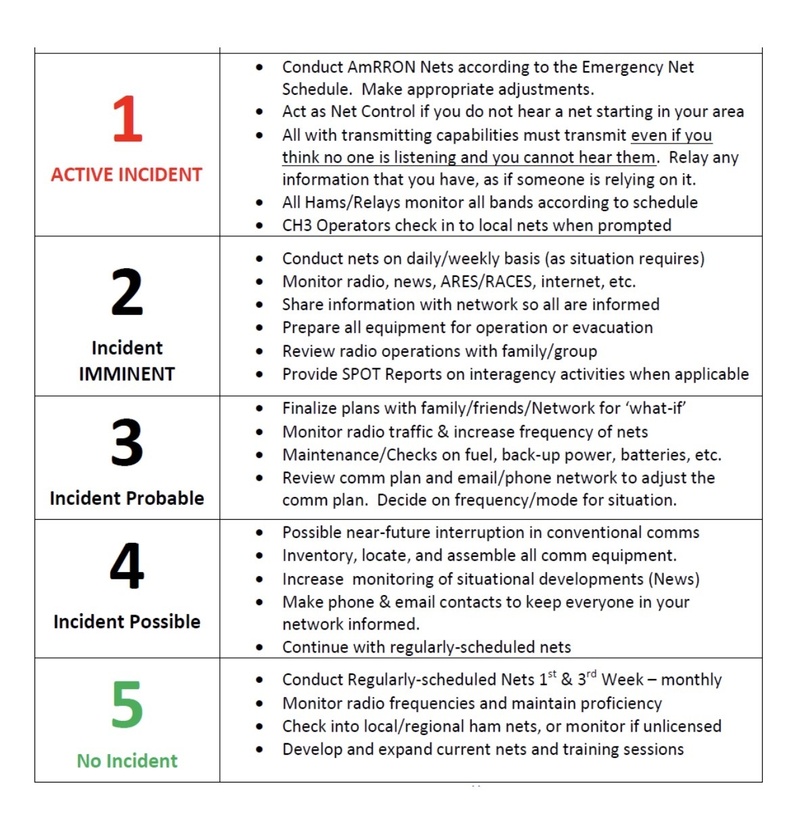

Raising to AmCON 3 (Incident Probable)

Due to the following: deteriorating negotiations between the United States and Iran; the surge in the past 48 hours of “final stage” US military assets into the Middle East; vacating US personnel from bases in Syria; the “Fatwa” issued last summer by Iranian clerics in the Summer of 2025 calling Muslims around the world to rise up if Iran is attacked; the numerous reports of Iranians who have infiltrated the US southern border in recent years and the warnings of “sleeper cells” in the United States, AmRRON is raising the AmCON one level, to Level 3 (Incident Probable).

AmRRON Special Guidance and Instructions:

AmRRON will remain at AmCON 3 until further notice, and we will continuously be monitoring the situation. Additional changes to the AmCON level, and any special instructions or guidance, will be posted here, as well as through the AmRRON member Telegram Channel, the AmRRON Corps Z-Net, and the AmRRON Mobile Team App....

If you’re a parent, this should make your stomach drop!

Every year, millions of families across America proudly display school photos of their children.

On refrigerators. In picture frames. Sent to grandparents and relatives across the country.

But here’s what most parents are never told…

Those school photos are taken by Lifetouch — the largest school photography company in America.

Lifetouch is owned by Shutterfly.

Shutterfly was acquired by Apollo Global Management.

And Apollo Global Management was co-founded by Leon Black — a name that appears in the Epstein files.

That means millions of children’s images are uploaded into databases every single year by a corporate structure tied to someone connected to Epstein.

Let that sink in!

https://vxtwitter.com/i/status/2019500982997041332