We know what’s coming and we are prepared.

🇬🇧🤡 How the British Government Covered Up 🇵🇰 Pakistani Grooming Gangs?

🇺🇸 US billionaire Elon Musk has sparked the controversy by calling out the UK government for failing to act on grooming gangs, which reportedly exploited 1,400+ children over the period of 1997-2013, while the authorities dismissed the issue.

💢 Musk labeled these crimes as a "mass crime" and accused PM Keir Starmer of complicity for not taking action.

What are these grooming gangs?

🤬 The grooming gangs, largely composed of men of Pakistani descent, targeted and abused young girls for years across cities like Rotherham, Rochdale, Telford, and others.

Threatening the victims with murder and threats of harming their families if they complained led many victims to suffer silently at the hands of the Islamists.

👮♀️ Investigations revealed systemic failures, with multiple scandals showing how authorities ignored or mishandled these crimes, because they feared of raising Islamophobic backlash in the country.

◾️ In 2023, then-Prime Minister Rishi Sunak launched a task force to combat grooming gangs, yet public outrage continues over the lack of accountability and delayed justice.

Chat | GG on Instagram | GG Movies Channel

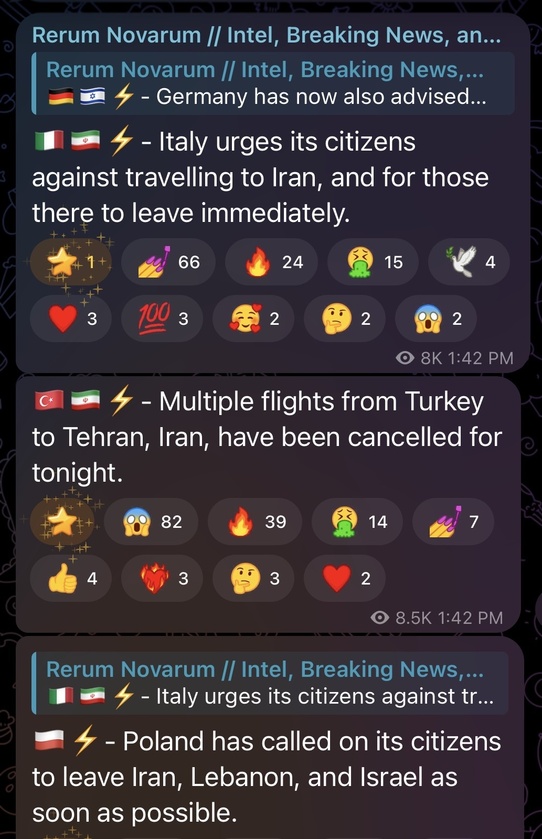

From the reports I continue to receive via Iranian channels, one conclusion is unmistakable: the ayatollahs are not impressed by the American military buildup. They read it as posture - not intent. In their assessment, Washington remains deeply reluctant to convert capability into decisive action.

By contrast, what truly shapes their operational preparations is the prospect of an Israeli strike. That scenario is taken far more seriously in Tehran - and it is driving decisions on the ground.

The events of June 2025 cemented this mindset. When the United States appears fully engaged in diplomacy, Iranian officials increasingly interpret it not as de-escalation - but as potential strategic cover.

On the night of June 12, 2025, President Trump posted on X:

“We remain committed to a diplomatic resolution of Iran’s nuclear issue. The entire government has been instructed to negotiate with Iran. They can be a great country, but first they must completely abandon any hope of acquiring ...

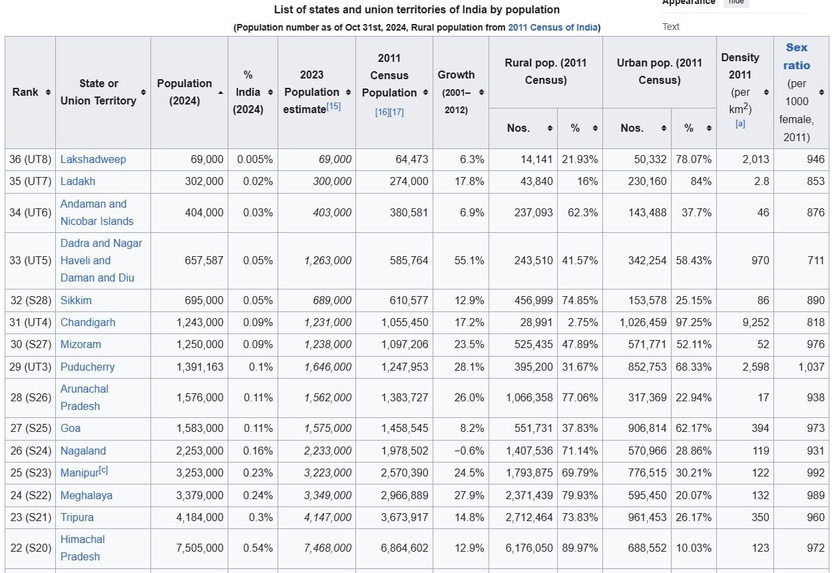

5.16-6.2 million Indians live in the United States. A larger population than that of 14 of India's own states and territories.

$38 billion in remittances flowed to India from the US in 2025.

Meanwhile, American tech grads struggle to find work while companies import more H1Bs.

@huwhitepapers

🔗 Read more on the replacement impact of high-skilled immigration here

🔗 Support us at our website here

🔗 Follow us on X