We know what’s coming and we are prepared.

Beijing's Green Light | zerohedge

⬛️ "China stimulus is coming"

🔶 After repeatedly teasing the idea of incoming stimulus several times last year, getting investors' hopes up only to scale it back and disappoint, recent memos from State officials give China's stimulus plans a precise framework they are looking to deliver on. Officials indicated they are waiting to launch the long-awaited "stimulus bazooka" once improving Chinese economic data is met with deteriorating US data.

🔶 This is a historically unusual combination, as global financial flows tend to move in sync (booms and busts are global). Never before has the US entered into a downturn without China. It suggests that Beijing is waiting for signs that the Mainland economy has decoupled before deploying roaring stimulus.

🔶 Finance Minister Lan Fuan points to the fact that Chinese strength relative to US weakness would necessarily attract new foreign direct investment (FDI). Positive real GDP and new FDI coupled with massive consumption stimulus is the path China seeks out of the stubborn economic malaise it has faced since Covid.

🔶 The Chinese State Council released a better-than-expected Q1 GDP report this week, and US GDP looks to decline in Q1. That's the exact divergence Chinese officials have been waiting for to greenlight massive stimulus.

🔶 Chinese stimulus will mean inflation (rising wages, growth and improved employment) and higher bond yields. China's lenders will be in a stronger position and credit spreads will lower. Chinese equities, specifically in sectors whose performance is tied to domestic demand, will also benefit. Demand for industrial commodities - in particular oil, copper and other metals - will increase.

🔶 Western officials continue to talk up looming delisting threats and investment bans, but both look to be far off as reciprocal investment bans from China could collapse the private sector and disturb the Treasury market in ways that would make the recent stress look like a walk in the park.

By DeathTaxesandQE

This guy wrote a 25 line Python script he claims "can probably unredact all of the Epstein files in less than 30 seconds".

"I am not suicidal, I am a great swimmer, and I look forward to living my life well into my 80s."

Follow @RealWideAwakeMedia for more content like this!

Merch: https://wideawake.clothing

X | YT | IG | Rumble

US / Iranian Conflict

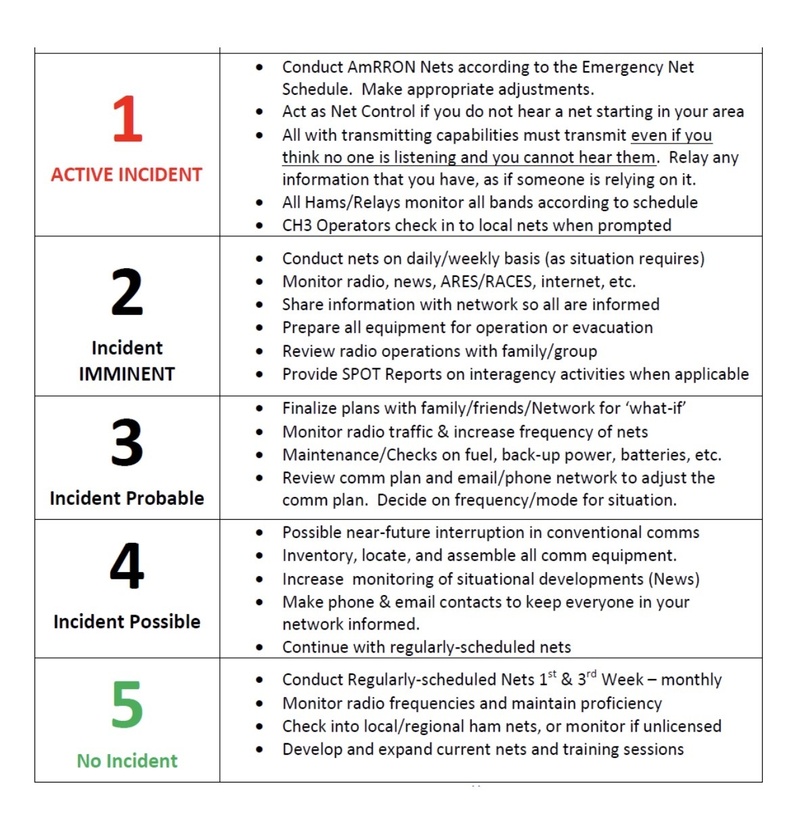

Raising to AmCON 3 (Incident Probable)

Due to the following: deteriorating negotiations between the United States and Iran; the surge in the past 48 hours of “final stage” US military assets into the Middle East; vacating US personnel from bases in Syria; the “Fatwa” issued last summer by Iranian clerics in the Summer of 2025 calling Muslims around the world to rise up if Iran is attacked; the numerous reports of Iranians who have infiltrated the US southern border in recent years and the warnings of “sleeper cells” in the United States, AmRRON is raising the AmCON one level, to Level 3 (Incident Probable).

AmRRON Special Guidance and Instructions:

AmRRON will remain at AmCON 3 until further notice, and we will continuously be monitoring the situation. Additional changes to the AmCON level, and any special instructions or guidance, will be posted here, as well as through the AmRRON member Telegram Channel, the AmRRON Corps Z-Net, and the AmRRON Mobile Team App....

If you’re a parent, this should make your stomach drop!

Every year, millions of families across America proudly display school photos of their children.

On refrigerators. In picture frames. Sent to grandparents and relatives across the country.

But here’s what most parents are never told…

Those school photos are taken by Lifetouch — the largest school photography company in America.

Lifetouch is owned by Shutterfly.

Shutterfly was acquired by Apollo Global Management.

And Apollo Global Management was co-founded by Leon Black — a name that appears in the Epstein files.

That means millions of children’s images are uploaded into databases every single year by a corporate structure tied to someone connected to Epstein.

Let that sink in!

https://vxtwitter.com/i/status/2019500982997041332