We know what’s coming and we are prepared.

Chances that Trump + Musk at DOGE + Bessent at Treasury could save the country from sovereign debt and currency crisis were always tiny.

Theres only one way to do that which does not involve collapse:

-

Fiscal Balance to prevent govt spending from draining reserves

-

Trade Balance to prevent private spending from draining reserves

-

Raise SLR Ratio

-

Establish a commodity currency capable of retiring debt without reducing m2 (monetize the assets on balance sheet)

-

Revalue credit Dollars vs Commodity such that AT LEAST a 40% Treasury/Fed Reserve Ratio can be maintained

LONDON ATTEMPTED THIS from 1919-1934 and FAILED.

NO ONE HAS EVER SUCCEEDED TO TRANSITION FROM FIAT TO TO COMMODITY CURRENCY WITH OUT TOTAL MONETARY COLLAPSE.

-

Courts are preventing Fiscal measures.

-

Congressional RINOs are staged to prevent trade measures through Tarriffs

-

No one in Congress or Business supports raising the SLR because it will bankrupt many banks. (Almost all will bankrupt in currency collapse, anyway - so higher SLR would actually save the strongest ones)

-

No one has audited whether the Gold is still there. Trading might indicate recent price rises were JP Morgan buying for NY FED to return past leases.

-

Without audit there's no basis to monetize the assets.

So...It probably will not happen.

What do you need to know?

First: Govt borrowing, and in fact all borrowing, is a logarithmic function of past compound interest on existing debt. Banks retain a portion of interest paid to secure future lending. The retention reduces M2 below the level required to retire old debts. Newer debts MUST be taken to re-enlarge M2 FOR SOLVENCY TO BE POSSIBLE.

See Fed M2 vs Debt chart. Dotted line is debt. Solid line is M2.

Second: Government is REQUIRED under Fed agreement to borrow more when private debt growth is insufficient.

Debt growth on the chart is too smoothly logarithmic to be organic. ERGO: IT IS INTENTIONAL. THEY SPEND IN ORDER TO BORROW NOT THE OTHER WAY AROUND.

Third: Note deviations in DEBT going all the way back to 1945/ Bretton Woods. It only happened in 2008. Slope resumed as a result of QE and zero rates. ERGO: Interruptions to LOGARITHMIC debt growth are fatal to the world wide monetary and financial system.

Fouth: Note ONLY deviations in M2 are in 2020. Theres a dip followed by a surge. ERGO: 2019 overnight freeze reflected impaired M2 relative to debt. Drops to a 5:1 DEBT:M2 Ratio risk currency crisis.

Fifth: Current ratio of Debt: M2 is just under 5:1 with debt growing significantly faster than M2.

Mathematically this is unrecoverable without major structural monetary reform within 15 years (at which point debt will nearly triple, while M2 doubles).

Without those major reforms Collapse will begin before the end of the decade (2030) as a Sovereign Debt Crisis, rapidly becoming a currency crisis.

You have fewer than 60 months to be prepared.

This guy wrote a 25 line Python script he claims "can probably unredact all of the Epstein files in less than 30 seconds".

"I am not suicidal, I am a great swimmer, and I look forward to living my life well into my 80s."

Follow @RealWideAwakeMedia for more content like this!

Merch: https://wideawake.clothing

X | YT | IG | Rumble

US / Iranian Conflict

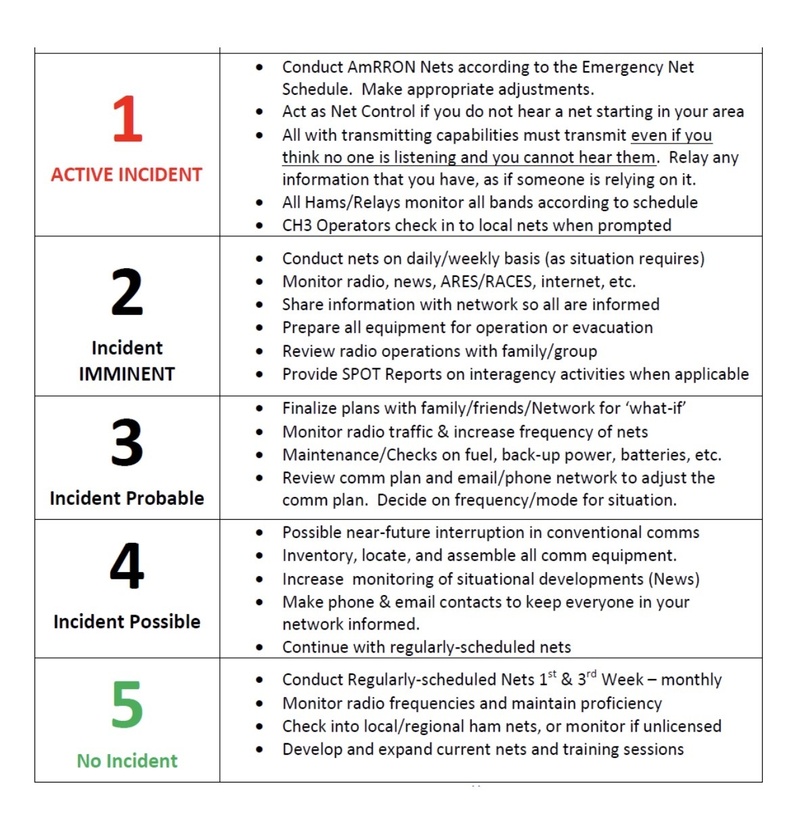

Raising to AmCON 3 (Incident Probable)

Due to the following: deteriorating negotiations between the United States and Iran; the surge in the past 48 hours of “final stage” US military assets into the Middle East; vacating US personnel from bases in Syria; the “Fatwa” issued last summer by Iranian clerics in the Summer of 2025 calling Muslims around the world to rise up if Iran is attacked; the numerous reports of Iranians who have infiltrated the US southern border in recent years and the warnings of “sleeper cells” in the United States, AmRRON is raising the AmCON one level, to Level 3 (Incident Probable).

AmRRON Special Guidance and Instructions:

AmRRON will remain at AmCON 3 until further notice, and we will continuously be monitoring the situation. Additional changes to the AmCON level, and any special instructions or guidance, will be posted here, as well as through the AmRRON member Telegram Channel, the AmRRON Corps Z-Net, and the AmRRON Mobile Team App....

If you’re a parent, this should make your stomach drop!

Every year, millions of families across America proudly display school photos of their children.

On refrigerators. In picture frames. Sent to grandparents and relatives across the country.

But here’s what most parents are never told…

Those school photos are taken by Lifetouch — the largest school photography company in America.

Lifetouch is owned by Shutterfly.

Shutterfly was acquired by Apollo Global Management.

And Apollo Global Management was co-founded by Leon Black — a name that appears in the Epstein files.

That means millions of children’s images are uploaded into databases every single year by a corporate structure tied to someone connected to Epstein.

Let that sink in!

https://vxtwitter.com/i/status/2019500982997041332