We know what’s coming and we are prepared.

1. Geopolitical & Military Tensions

Thailand–Cambodia conflict: Martial law has been declared, over 138,000 people have fled, and both sides have exchanged fire. Terrain challenges and border disputes intensify risks of prolonged conflict.

Middle East flashpoints: The Gaza conflict escalates as Israel prepares for a major offensive and new ceasefire efforts stall. Suwayda, Syria, sees Druze self-administration declared.

Russia–Ukraine talks: Zelensky confirms negotiations, but a Putin-Zelensky meeting is still seen as unlikely by the Kremlin.

ISIS strike: U.S. CENTCOM killed a senior ISIS leader and his sons in Syria.

2. Western Politics, Immigration, and Populism

UK Islamophobia sentiment: A new survey shows over 50% of Britons view Islam as incompatible with British values, potentially fueling anti-immigration politics.

Jeremy Corbyn’s new party: Gathers 200,000 members; promotes anti-austerity, pro-immigrant policies in contrast to rising nationalist sentiment.

Anti-migration protests: Spread across the UK, leading to local council actions and enforcement under new online safety laws.

3. Major Shifts in Global Tech and Business

Meta bans political ads in EU: Cites new EU rules as "unworkable," halting political advertising on Facebook and Instagram.

Microsoft ends passwords: Shifting to passkeys, Face ID, and biometrics by August 1.

TikTok's future uncertain in the U.S.: Commerce Secretary warns of shutdown unless China approves an ownership transfer.

Used EVs lose 40% value in year: Highlights growing concerns about resale and sustainability.

Unitree humanoid robot: Released for $5,900, reflecting major drop in consumer robot prices.

4. Trump, Epstein & Political Scandal Fallout

Trump distances from Epstein: Denies visiting his island, urges focus on Clinton and others.

Ghislaine Maxwell cooperation: Provides names of 100 linked individuals under partial immunity.

Newsmax labels Maxwell a “victim”: Raises questions due to ties with former Trump cabinet officials.

Trump’s policy moves: Claws back $9B in foreign aid and public broadcasting funding, hints at using tariffs to fund rebates.

5. Global Economic Unrest & Social Shifts

Porsche profits plummet 91%: Leads to job cuts in Germany, symbolic of broader luxury market strain.

France to recognize Palestine: Macron commits to UN announcement in September, drawing sharp rebuke from the U.S. and Israel.

UN court ruling on climate: Declares climate change a universal human threat, formalizing climate migrants under international law.

Argentina’s consumption boom: Driven by political cycles and inflation expectations.

Bezos sells $5.7B in shares: Possibly reflecting market repositioning or personal financial planning.

This guy wrote a 25 line Python script he claims "can probably unredact all of the Epstein files in less than 30 seconds".

"I am not suicidal, I am a great swimmer, and I look forward to living my life well into my 80s."

Follow @RealWideAwakeMedia for more content like this!

Merch: https://wideawake.clothing

X | YT | IG | Rumble

US / Iranian Conflict

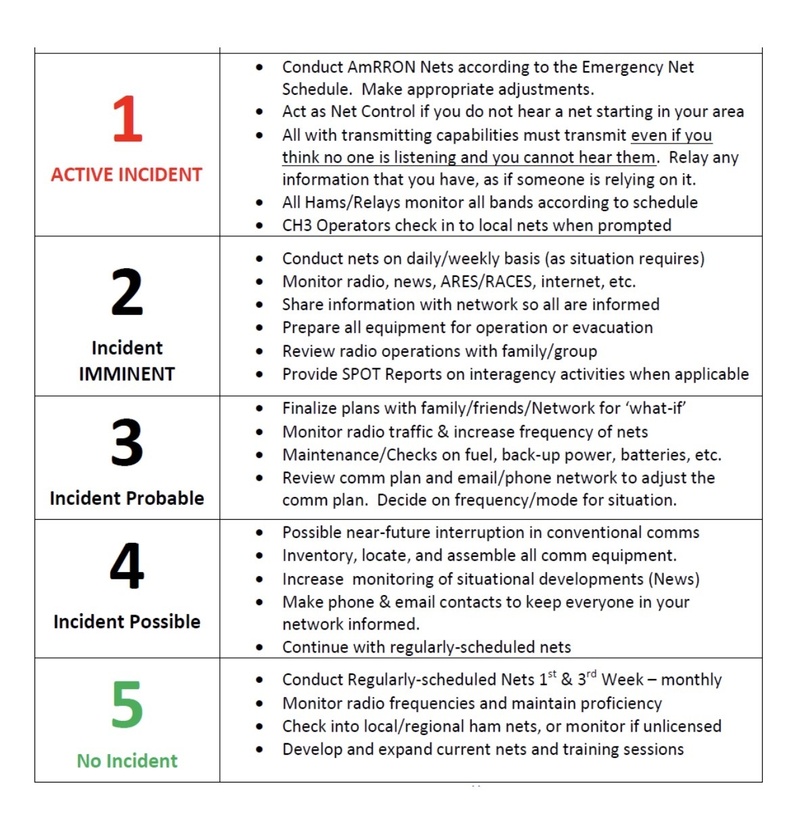

Raising to AmCON 3 (Incident Probable)

Due to the following: deteriorating negotiations between the United States and Iran; the surge in the past 48 hours of “final stage” US military assets into the Middle East; vacating US personnel from bases in Syria; the “Fatwa” issued last summer by Iranian clerics in the Summer of 2025 calling Muslims around the world to rise up if Iran is attacked; the numerous reports of Iranians who have infiltrated the US southern border in recent years and the warnings of “sleeper cells” in the United States, AmRRON is raising the AmCON one level, to Level 3 (Incident Probable).

AmRRON Special Guidance and Instructions:

AmRRON will remain at AmCON 3 until further notice, and we will continuously be monitoring the situation. Additional changes to the AmCON level, and any special instructions or guidance, will be posted here, as well as through the AmRRON member Telegram Channel, the AmRRON Corps Z-Net, and the AmRRON Mobile Team App....

If you’re a parent, this should make your stomach drop!

Every year, millions of families across America proudly display school photos of their children.

On refrigerators. In picture frames. Sent to grandparents and relatives across the country.

But here’s what most parents are never told…

Those school photos are taken by Lifetouch — the largest school photography company in America.

Lifetouch is owned by Shutterfly.

Shutterfly was acquired by Apollo Global Management.

And Apollo Global Management was co-founded by Leon Black — a name that appears in the Epstein files.

That means millions of children’s images are uploaded into databases every single year by a corporate structure tied to someone connected to Epstein.

Let that sink in!

https://vxtwitter.com/i/status/2019500982997041332