We know what’s coming and we are prepared.

🇺🇸 The Sahm Rule Was Right All Along

The Sahm Rule is one of the cleanest, most reliable ways to identify when the U.S. is in recession. It’s simple: if the three month average unemployment rate rises half a percentage point above its 12 month low, you’re already in one. It’s not about forecasts, it’s a contemporaneous signal and it’s been 100% accurate since the 1970s. When it flirted with activation in 2023, Claudia Sahm herself urged caution because of pandemic era distortions, but she also stressed that if it flipped cleanly, it meant the labor market was weaker than the glossy headlines implied.

Fast forward, and the revisions now show that’s exactly what happened. In August 2024, BLS benchmark adjustments erased 818,000 jobs. By February 2025, another 589,000 were gone. And just recently, Treasury Secretary Scott Bessent flagged that another 800,000 could be stripped out. Add to that the steady drip of downward revisions through 2025, June flipping from a modest gain to a net job loss and the labor market has been overstated by somewhere between 2.3 and 2.4 million jobs since April 2023.

Like i said in my previous post that kind of wholesale rewrite hasn’t happened since 2009, when the BLS had to admit it had massively overstated payrolls heading into the financial crisis. And history shows that these benchmark adjustments aren’t just statistical clean up. They almost always surface at turning points, the stagflationary recession of the mid 1970s, the double dip downturn in the early 1980s, and the collapse of 2007-09. They’re usually evidence that the economy was already much weaker beneath the surface, and the headline strength was more illusion than fact.

Which brings us back to the Sahm Rule. On the charts today, the indicator looks muted, sitting well below the 0.5 threshold. But that’s because the unemployment rate itself has been calculated off job counts that are now being revised down. If those missing millions of jobs had been reflected at the time, the unemployment rate would have been higher, the Sahm Rule would have ticked up, and the U.S. might already be shown as having tripped into recession. In other words, the Sahm Rule didn’t miss, the inputs did. Once the revisions are fully baked in, history may show it was flashing red in 2023 while policymakers insisted on labor resilience.

That’s what makes this so consequential. For two years, the Fed leaned on the strong jobs market as its justification for keeping rates higher for longer. But if those jobs never really existed, then the Fed was tightening into fragility. That turns its high for longer stance into a policy error built on faulty data.

Which is why the September 17, 2025 cut is unlikely to be a one off. As these revisions settle and the depth of labor weakness becomes impossible to deny, the Fed won’t just be trimming for optics. It will be forced into a broader pivot in 2026 acknowledging, belatedly, that the Sahm Rule was right all along.

🔗 EndGame Macro

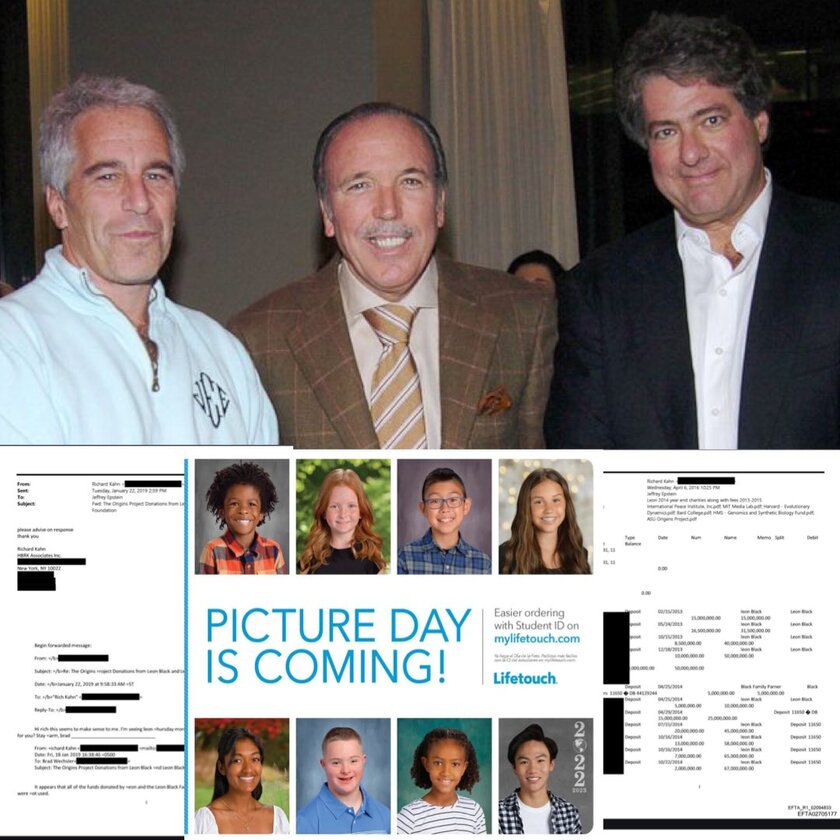

This guy wrote a 25 line Python script he claims "can probably unredact all of the Epstein files in less than 30 seconds".

"I am not suicidal, I am a great swimmer, and I look forward to living my life well into my 80s."

Follow @RealWideAwakeMedia for more content like this!

Merch: https://wideawake.clothing

X | YT | IG | Rumble

If you’re a parent, this should make your stomach drop!

Every year, millions of families across America proudly display school photos of their children.

On refrigerators. In picture frames. Sent to grandparents and relatives across the country.

But here’s what most parents are never told…

Those school photos are taken by Lifetouch — the largest school photography company in America.

Lifetouch is owned by Shutterfly.

Shutterfly was acquired by Apollo Global Management.

And Apollo Global Management was co-founded by Leon Black — a name that appears in the Epstein files.

That means millions of children’s images are uploaded into databases every single year by a corporate structure tied to someone connected to Epstein.

Let that sink in!

https://vxtwitter.com/i/status/2019500982997041332

Reinsurance Group of America (RGA) exits its US healthcare business after a 40% price increase focused on profitability rather than market share.

I wonder what could be the cause?🤡

EDWARD DOWD