We know what’s coming and we are prepared.

Last week we asked (and attempted to answer) whether a medium-sized canary just croak in the coalmine of consumer credit?

The candidate was little-known Tricolor Holdings - a subprime auto-lender - that had suddenly, overnight, collapsed amid allegations of fraud and whether the same collateral was pledged to multiple lenders.

This dead canary was quickly followed by the exploration of bankruptcy proceedings by car parts supplier First Brands Group, wrongfooting investors further.

Tricolor had won pristine triple-A ratings as it borrowed in credit markets, while First Brands may have amassed as much as $10bn in debt and off-balance sheet financing and was close to raising even more last month.

Investors were ready to dismiss each as one-off incidents, but as The FT reports, taken together, the two offer signs of cracks within credit markets, which have become a critical source of funding for consumers and businesses as traditional banks have retreated since the financial crisis.

One investor who sold out of Tricolor debt last week said the collapse of the company and ensuing market turmoil was one of the “worst things I’ve ever seen in the asset-backed securities” market.

Fear over the unravelling of Tricolor and First Brands threatens to take the shine off one of the hottest corners of finance.

Asset-backed credit is not a new product, but it is rapidly evolving, as titans on Wall Street such as Apollo Global Management and KKR devise new ways to lend.

And that 'unraveling' has finally reached the headlines of various trading desks as 'Alts' have plunged in recent days (with no obvious catalyst, according to Goldman Sachs traders).

White line = GS Capital Markets Exposed Custom Basket, Blue = Banks, Orange = GS Custom Alts basket, Purple = Financials, Yellow = S&P 500

Goldman's Christian DeGrasse confirms there is no obvious culprit (some have pointed to the Financial Times article linked above on private credit but negative headlines are not new to today), and I imagine there’s a lot of ‘it’s crowded’ explanations flying out there.

Most notably, DeGrasse highlights that questions on Alts were the trading desks' top inbound by far (!).

What I would say is this – we’ve been vocal in our notes & calls on desk that amidst the alts rally and catchup (to banks / cap mkt exposed names), there’s been a notable lack of long-duration interest in chasing.

Not saying this crowd doesn’t own them, but the net incremental interest / inflow has slowed significantly and our sense is the ‘catchup’ trade up vs the banks during September was driven predominately by fast money HFs, which entering October are likely wondering whether they still want to be long these month (moves in stock vs. earnings revisions are now looking off in several of these…) after what’s been a good few weeks.. Add on to that some fuel from a momentum move (+ general pain from Info services) and you get today.

Quickly on the alts & after market monetization news...

We’ve been pointing to 3 main points for why Longer duration money hasn’t been adding to the alts, one of which is the debate on whether they are participating in the capital market rally to the same extent as what high valuations would imply .. Would note both KKR and BX put out their estimated monetization numbers for the qtr, and KKR disclosed monetization activity above >$925mn, with consensus closer to ~$700mn – which bulls are arguing shows at least some PE is participating in the current capital market wave (or, as one inbound put it, ‘not all PE books are the same)’ .. BX’s monetization number of >$525mn through Sept ’24 on the other hand does look slightly light of cons (~$645mn?) but worth noting another week of qtr (and this est often proves to be conservative).

Nevertheless, while traders can't pin down the driver of the weakness in 'Alts', The FT concludes that several large banks have also been caught up in the collapse, including JPMorgan Chase and Fifth Third, which are exposed to losses on hundreds of millions of dollars' worth of auto loans.

A second investor who has since sold their position in packaged-up Tricolor loans said they had no idea how potential financial irregularities went unnoticed by JPMorgan Chase, one of the banks that underwrote debt offerings.

“That’s the shocking part of it,” the investor said. “JPMorgan is one of the most sophisticated lenders in the entire world. How the hell could they have missed this?”

JPMorgan declined to comment.

This guy wrote a 25 line Python script he claims "can probably unredact all of the Epstein files in less than 30 seconds".

"I am not suicidal, I am a great swimmer, and I look forward to living my life well into my 80s."

Follow @RealWideAwakeMedia for more content like this!

Merch: https://wideawake.clothing

X | YT | IG | Rumble

US / Iranian Conflict

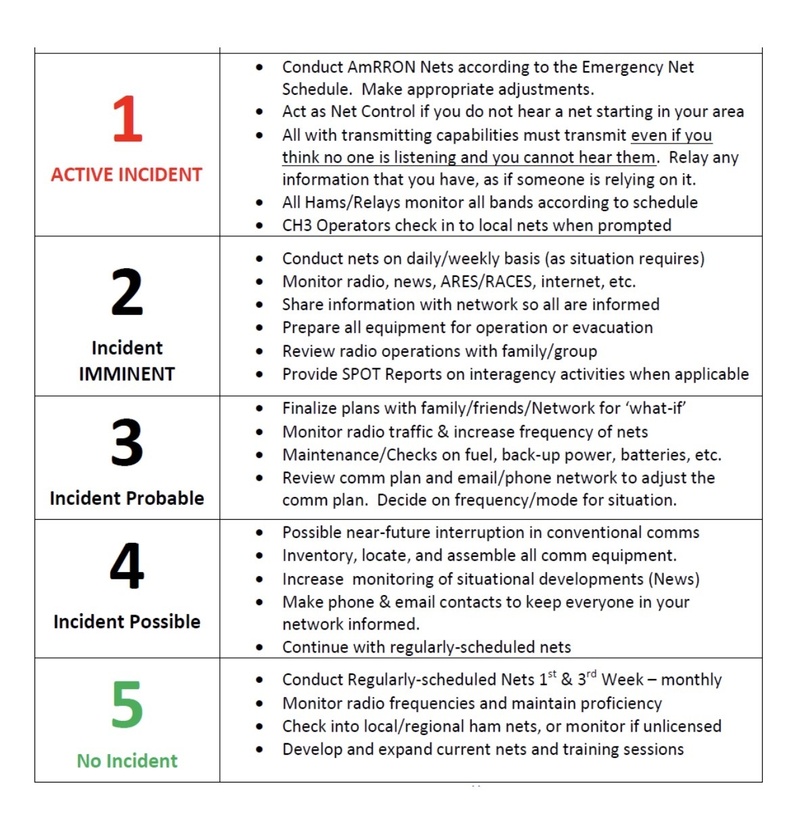

Raising to AmCON 3 (Incident Probable)

Due to the following: deteriorating negotiations between the United States and Iran; the surge in the past 48 hours of “final stage” US military assets into the Middle East; vacating US personnel from bases in Syria; the “Fatwa” issued last summer by Iranian clerics in the Summer of 2025 calling Muslims around the world to rise up if Iran is attacked; the numerous reports of Iranians who have infiltrated the US southern border in recent years and the warnings of “sleeper cells” in the United States, AmRRON is raising the AmCON one level, to Level 3 (Incident Probable).

AmRRON Special Guidance and Instructions:

AmRRON will remain at AmCON 3 until further notice, and we will continuously be monitoring the situation. Additional changes to the AmCON level, and any special instructions or guidance, will be posted here, as well as through the AmRRON member Telegram Channel, the AmRRON Corps Z-Net, and the AmRRON Mobile Team App....

If you’re a parent, this should make your stomach drop!

Every year, millions of families across America proudly display school photos of their children.

On refrigerators. In picture frames. Sent to grandparents and relatives across the country.

But here’s what most parents are never told…

Those school photos are taken by Lifetouch — the largest school photography company in America.

Lifetouch is owned by Shutterfly.

Shutterfly was acquired by Apollo Global Management.

And Apollo Global Management was co-founded by Leon Black — a name that appears in the Epstein files.

That means millions of children’s images are uploaded into databases every single year by a corporate structure tied to someone connected to Epstein.

Let that sink in!

https://vxtwitter.com/i/status/2019500982997041332