We know what’s coming and we are prepared.

🇺🇸📉💸 Regional banks are facing a perfect storm of credit problems, with commercial real estate loans comprising 44% of their portfolios versus just 13% for large banks. Office loan delinquencies have hit 10.4%, approaching 2008 crisis levels, while over $1 trillion in CRE loans must refinance by year-end in a higher-rate environment.

The Fraud Factor

Recent disclosures reveal deeper problems beyond market stress. Zions Bancorporation disclosed $60 million in provisions and $50 million in write-offs related to alleged loan fraud from its California division, while Western Alliance faced similar issues. These incidents echo Jamie Dimon's warning about "more cockroaches" in the credit market, suggesting systematic underwriting problems beyond economic cycles.

The Concentration Risk

Florida Atlantic University analysis found 59 of the 158 largest banks have CRE exposures exceeding 300% of total equity capital. New York Community Bancorp's Flagstar subsidiary shows a particularly dangerous 477% CRE concentration ratio. Many banks are using "extend and pretend" strategies, restructuring loans to avoid immediate write-offs while masking underlying problems.

The Systemic Implications

Studies suggest a 1% increase in non-performing loan ratios can decrease GDP growth by 0.1%, creating vicious cycles where economic weakness worsens credit quality. The concentration of regional bank problems in CRE mirrors historical patterns from the S&L crisis of the 1980s, when similar interest rate and real estate pressures caused widespread failures.

My Take

This analysis confirms that March 2023's regional banking crisis was papered over rather than resolved. The combination of CRE concentration, interest rate pressure, and emerging fraud cases suggests the underlying problems have worsened. When banks resort to extend-and-pretend strategies while facing refinancing walls on $1 trillion in loans, it creates conditions for a more severe crisis than what we saw in 2023. The moral hazard from implicit government backstops has encouraged more risk-taking rather than better management.

🔗 Hedgie

This guy wrote a 25 line Python script he claims "can probably unredact all of the Epstein files in less than 30 seconds".

"I am not suicidal, I am a great swimmer, and I look forward to living my life well into my 80s."

Follow @RealWideAwakeMedia for more content like this!

Merch: https://wideawake.clothing

X | YT | IG | Rumble

US / Iranian Conflict

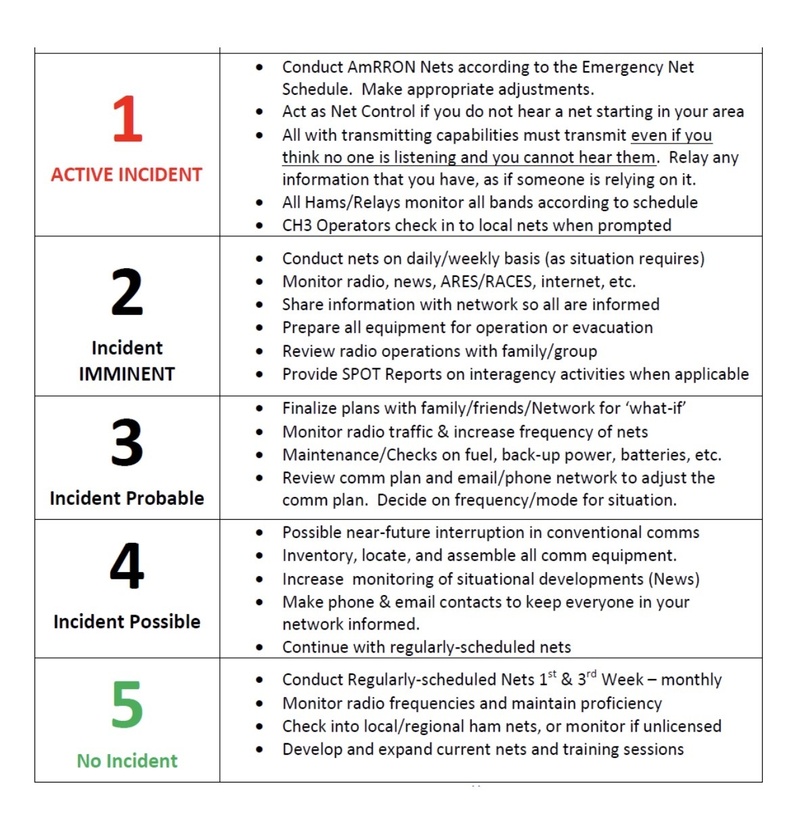

Raising to AmCON 3 (Incident Probable)

Due to the following: deteriorating negotiations between the United States and Iran; the surge in the past 48 hours of “final stage” US military assets into the Middle East; vacating US personnel from bases in Syria; the “Fatwa” issued last summer by Iranian clerics in the Summer of 2025 calling Muslims around the world to rise up if Iran is attacked; the numerous reports of Iranians who have infiltrated the US southern border in recent years and the warnings of “sleeper cells” in the United States, AmRRON is raising the AmCON one level, to Level 3 (Incident Probable).

AmRRON Special Guidance and Instructions:

AmRRON will remain at AmCON 3 until further notice, and we will continuously be monitoring the situation. Additional changes to the AmCON level, and any special instructions or guidance, will be posted here, as well as through the AmRRON member Telegram Channel, the AmRRON Corps Z-Net, and the AmRRON Mobile Team App....

If you’re a parent, this should make your stomach drop!

Every year, millions of families across America proudly display school photos of their children.

On refrigerators. In picture frames. Sent to grandparents and relatives across the country.

But here’s what most parents are never told…

Those school photos are taken by Lifetouch — the largest school photography company in America.

Lifetouch is owned by Shutterfly.

Shutterfly was acquired by Apollo Global Management.

And Apollo Global Management was co-founded by Leon Black — a name that appears in the Epstein files.

That means millions of children’s images are uploaded into databases every single year by a corporate structure tied to someone connected to Epstein.

Let that sink in!

https://vxtwitter.com/i/status/2019500982997041332