We know what’s coming and we are prepared.

🇯🇵 Here is what's going on with Japan's massive stimulus package and why everyone's freaking out about it right now.

The timing and scale of this is genuinely significant and there are real implications for global markets and the yen that go way beyond just Japan (save this).

Japan just approved a ¥21.3 trillion economic stimulus package, the biggest since covid to help households deal with rising costs and try to jumpstart their economy after it shrank 1.8% in Q3. The package includes ¥17.7 trillion in fresh spending through an extra budget plus ¥2.7 trillion in tax cuts. When you add in local government spending and private sector investments the total impact balloons to ¥42.8 trillion. That's substantially bigger than last year's ¥39 trillion package.

The government is throwing money at everything, ¥20,000 cash handouts per child subsidies for electricity and gas bills (about ¥7,000 per household over three months), rice vouchers, scrapping the provisional gasoline tax, and raising the tax free income threshold. They're also pumping billions into strategic sectors like AI, semiconductors, and shipbuilding. Prime Minister Sanae Takaichi who just took office last month is going full fiscal dove mode and markets are not exactly thrilled about it.

Here's where it gets messy. Japans debt is already over twice the size of its economy, literally the worst among developed nations. This massive spending spree means they need to issue even more government bonds, probably exceeding the ¥6.69 trillion they borrowed last year. That's spooked bond markets hard. Japanese government bonds yields have hit record highs. And the yen? It's gotten crushed, hitting 10 month lows around 157 per dollar.

So what does this all mean? In the short term, Japan's stimulus is creating chaos instead of clarity. Bond vigilantes are punishing Japan for fiscal recklessness by selling JGBs and yen. The market is worried about Japan's deteriorating fiscal health and what happens when you have massive government spending combined with potential central bank tightening. That uncertainty is bleeding into global risk assets across the board.

The implications are pretty significant. If Japan's fiscal situation continues to deteriorate and they keep issuing bonds at this pace, it could force the Bank of Japan's hand on rate hikes sooner than expected. That would strengthen the yen and potentially trigger selloffs across equities and bonds in the US. We saw a preview of this in August 2024 when the BOJ unexpectedly raised rates and triggered a global market freakout with the Nikkei dropping 12% in one day.

On the flip side if the stimulus actually works and injects enough liquidity into the system without triggering a BOJ rate hike, it could eventually be positive for risk assets as yen weakness drives capital into alternative investments. But that's the optimistic case and depends on a lot of things going right namely the BOJ staying accommodative while fiscal expansion does its job.

🔗 Stock Market News

This guy wrote a 25 line Python script he claims "can probably unredact all of the Epstein files in less than 30 seconds".

"I am not suicidal, I am a great swimmer, and I look forward to living my life well into my 80s."

Follow @RealWideAwakeMedia for more content like this!

Merch: https://wideawake.clothing

X | YT | IG | Rumble

US / Iranian Conflict

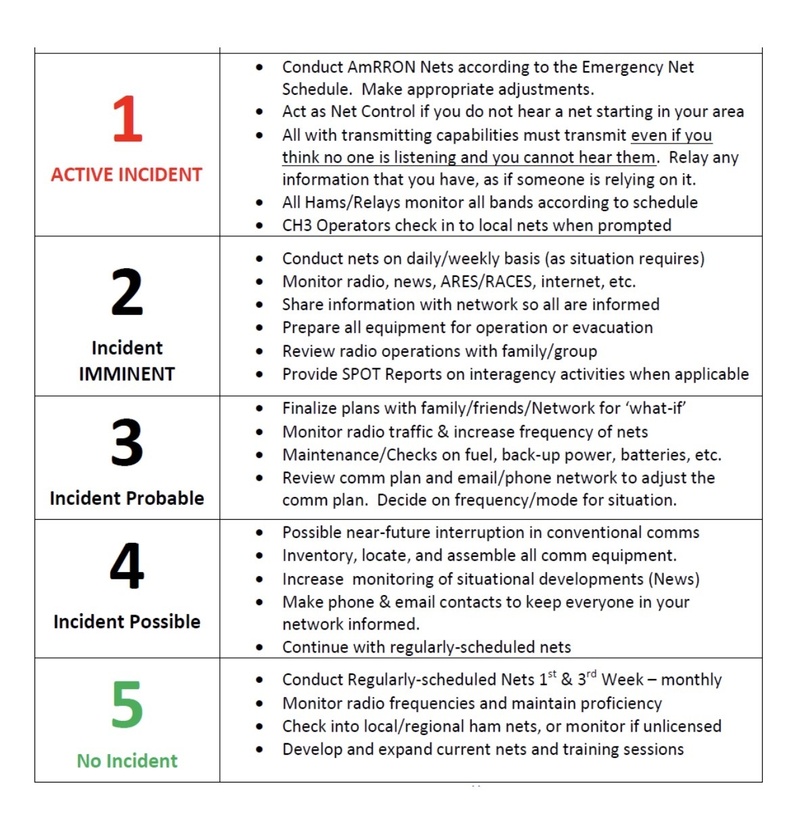

Raising to AmCON 3 (Incident Probable)

Due to the following: deteriorating negotiations between the United States and Iran; the surge in the past 48 hours of “final stage” US military assets into the Middle East; vacating US personnel from bases in Syria; the “Fatwa” issued last summer by Iranian clerics in the Summer of 2025 calling Muslims around the world to rise up if Iran is attacked; the numerous reports of Iranians who have infiltrated the US southern border in recent years and the warnings of “sleeper cells” in the United States, AmRRON is raising the AmCON one level, to Level 3 (Incident Probable).

AmRRON Special Guidance and Instructions:

AmRRON will remain at AmCON 3 until further notice, and we will continuously be monitoring the situation. Additional changes to the AmCON level, and any special instructions or guidance, will be posted here, as well as through the AmRRON member Telegram Channel, the AmRRON Corps Z-Net, and the AmRRON Mobile Team App....

If you’re a parent, this should make your stomach drop!

Every year, millions of families across America proudly display school photos of their children.

On refrigerators. In picture frames. Sent to grandparents and relatives across the country.

But here’s what most parents are never told…

Those school photos are taken by Lifetouch — the largest school photography company in America.

Lifetouch is owned by Shutterfly.

Shutterfly was acquired by Apollo Global Management.

And Apollo Global Management was co-founded by Leon Black — a name that appears in the Epstein files.

That means millions of children’s images are uploaded into databases every single year by a corporate structure tied to someone connected to Epstein.

Let that sink in!

https://vxtwitter.com/i/status/2019500982997041332