We know what’s coming and we are prepared.

remove

What do they know that we don’t?

Reality dawns.

Davos 2024

Oh blimey!

The debt fuelled growth model of globalisation never had a long term future.

Sustainable growth.

So easy to say, so hard for global policymakers to achieve.

What confuses global policymakers so much?

Banks create money and debt at the same time.

Banks create the money first and then they have to get it back again to balance the books.

The economy booms on the money creation of bank credit, but policymakers are oblivious to the claims on future spending power piling up in the banking system.

At 25.30 mins you can see the super imposed private debt-to-GDP ratios.

China has just reached the end of the road with the debt fuelled growth model of globalisation.

We got there in 2008, and have referred to it as the Productivity Puzzle ever since (UK).

Not considering private debt always was the Achilles heel of neoclassical economics.

How private banks create the...

This guy wrote a 25 line Python script he claims "can probably unredact all of the Epstein files in less than 30 seconds".

"I am not suicidal, I am a great swimmer, and I look forward to living my life well into my 80s."

Follow @RealWideAwakeMedia for more content like this!

Merch: https://wideawake.clothing

X | YT | IG | Rumble

US / Iranian Conflict

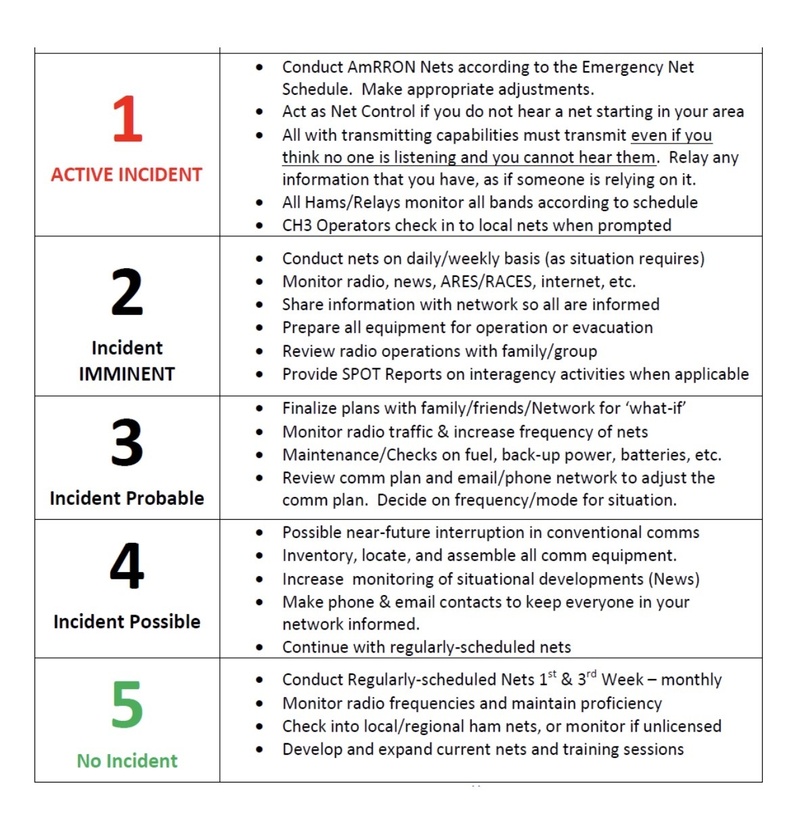

Raising to AmCON 3 (Incident Probable)

Due to the following: deteriorating negotiations between the United States and Iran; the surge in the past 48 hours of “final stage” US military assets into the Middle East; vacating US personnel from bases in Syria; the “Fatwa” issued last summer by Iranian clerics in the Summer of 2025 calling Muslims around the world to rise up if Iran is attacked; the numerous reports of Iranians who have infiltrated the US southern border in recent years and the warnings of “sleeper cells” in the United States, AmRRON is raising the AmCON one level, to Level 3 (Incident Probable).

AmRRON Special Guidance and Instructions:

AmRRON will remain at AmCON 3 until further notice, and we will continuously be monitoring the situation. Additional changes to the AmCON level, and any special instructions or guidance, will be posted here, as well as through the AmRRON member Telegram Channel, the AmRRON Corps Z-Net, and the AmRRON Mobile Team App....

If you’re a parent, this should make your stomach drop!

Every year, millions of families across America proudly display school photos of their children.

On refrigerators. In picture frames. Sent to grandparents and relatives across the country.

But here’s what most parents are never told…

Those school photos are taken by Lifetouch — the largest school photography company in America.

Lifetouch is owned by Shutterfly.

Shutterfly was acquired by Apollo Global Management.

And Apollo Global Management was co-founded by Leon Black — a name that appears in the Epstein files.

That means millions of children’s images are uploaded into databases every single year by a corporate structure tied to someone connected to Epstein.

Let that sink in!

https://vxtwitter.com/i/status/2019500982997041332