We know what’s coming and we are prepared.

Economics by Wes.....

Imagine you wanted to buy things online and websites only accepted paypal. You didn't mind at first but then paypal started taking 2% more of your money each year. If they found out you did something they didn't like, they would suspend your ability to conduct any transactions. But you have to use them because all the websites you order things from only take paypal. Paypal knows this too and locked in the merchants with a 50 year agreement. Then they start taking 20% of your transactions as fees every year instead of the old 2%.

This really sucks but they are the only game in town..... Imagine what would happen if all the merchants started accepting Visa and Mastercard. All the people who hated paypal's fees and arbitrary lockout rules would cash out their paypal balance and GTFO and run to MasterCard.

Friends this is what just happened in the world last night. In 1974 the US entered into an agreement with Saudi to sell oil only in dollars for 50 years. Along the way, the US has continued to print money and devalue the dollars held in other nation's vaults for international trade. The US has imposed sanctions on countries we didn't like by locking them out of the SWIFT payment system. The EU did the same to Russia two junes ago. Russia needed to make a payment of $40M to the EU but the EU had frozen their bank account.... the money was there, the bank would not process the transaction. These sorts of stunts have made other countries hate having to deal in US dollars (ie paypal). The first alternative that comes along will have everyone jumping to it.

Presently there are about 40 nations involved in BRICS. Their combined GDP is greater than the G7 nations. Those nations no longer have to use USD and you can bet they will be cashing out of dollars.

I'm telling you this because you need to buy the things you think you will need in the furture TODAY. You will look back on this month in the next year and see an inflexion point in the chart of inflation.

How many of you hesitated to buy 9mm when it was 18c a round? Boy you'd love 18c 9mm right now wouldn't you? Boy you'd love 25c 5.56 right now wouldn't you? Don't get a year down the road and wish you'd bought a tiller or solar, or a generator.... or a spare water pump. Trust me you will look back on today and wish you had bought something.

This guy wrote a 25 line Python script he claims "can probably unredact all of the Epstein files in less than 30 seconds".

"I am not suicidal, I am a great swimmer, and I look forward to living my life well into my 80s."

Follow @RealWideAwakeMedia for more content like this!

Merch: https://wideawake.clothing

X | YT | IG | Rumble

US / Iranian Conflict

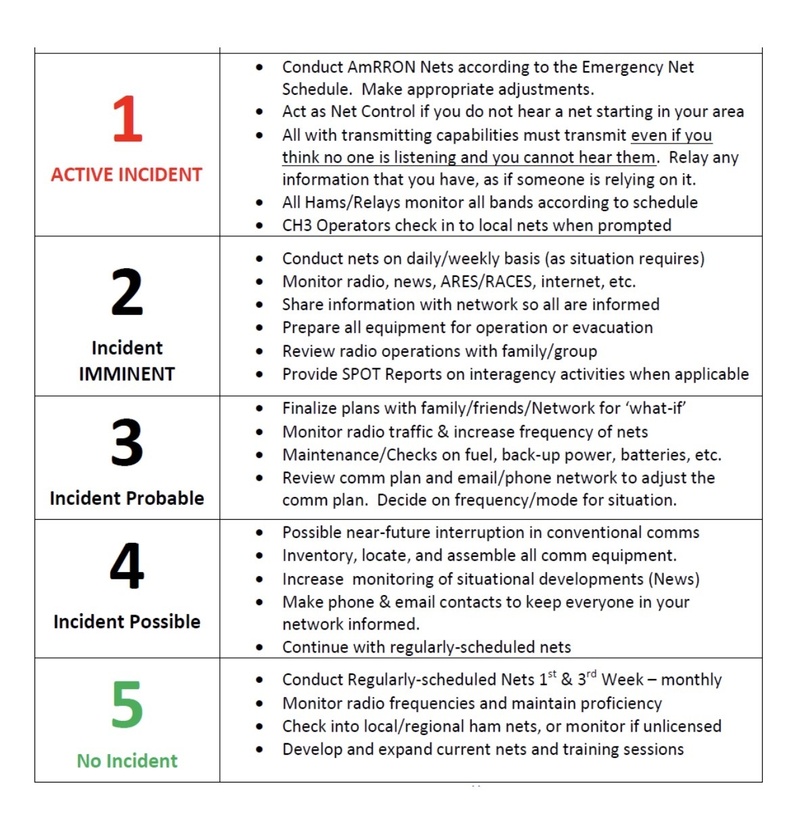

Raising to AmCON 3 (Incident Probable)

Due to the following: deteriorating negotiations between the United States and Iran; the surge in the past 48 hours of “final stage” US military assets into the Middle East; vacating US personnel from bases in Syria; the “Fatwa” issued last summer by Iranian clerics in the Summer of 2025 calling Muslims around the world to rise up if Iran is attacked; the numerous reports of Iranians who have infiltrated the US southern border in recent years and the warnings of “sleeper cells” in the United States, AmRRON is raising the AmCON one level, to Level 3 (Incident Probable).

AmRRON Special Guidance and Instructions:

AmRRON will remain at AmCON 3 until further notice, and we will continuously be monitoring the situation. Additional changes to the AmCON level, and any special instructions or guidance, will be posted here, as well as through the AmRRON member Telegram Channel, the AmRRON Corps Z-Net, and the AmRRON Mobile Team App....

If you’re a parent, this should make your stomach drop!

Every year, millions of families across America proudly display school photos of their children.

On refrigerators. In picture frames. Sent to grandparents and relatives across the country.

But here’s what most parents are never told…

Those school photos are taken by Lifetouch — the largest school photography company in America.

Lifetouch is owned by Shutterfly.

Shutterfly was acquired by Apollo Global Management.

And Apollo Global Management was co-founded by Leon Black — a name that appears in the Epstein files.

That means millions of children’s images are uploaded into databases every single year by a corporate structure tied to someone connected to Epstein.

Let that sink in!

https://vxtwitter.com/i/status/2019500982997041332