We know what’s coming and we are prepared.

A jury found five defendants guilty and two not guilty on Friday in the first trial in the nation's largest pandemic relief fraud case.

They faced a total of 41 charges — chiefly wire fraud, bribery and money laundering - alleging they claimed to give away 18.8 million meals to needy children from 50 sites across the state.

Prosecutors said they fabricated invoices and submitted thousands of phony names of children in order to get $49 million in federal funds.

Said Shafii Farah and Abdiwahab Maalim Aftin were acquitted of all charges against them, while the others had a mix of convictions and acquittals.

Assistant U.S. Attorney Joseph Thompson held a brief press conference and said, "We're pleased with the verdict. We're proud of the trial."

He said the outcome confirms what the feds knew all along: That members of the group falsified documents, lied and claimed to be serving millions of meals, taking advantage of a global pandemic to defraud the public and steal millions of dollars.

"This conduct was not just criminal, it was depraved and brazen," Thompson said. "Evidence showed how brazen the scheme was, and how

The verdict came at the end of a chaotic week, when the first day of jury deliberations was marked by chaos Monday, as federal prosecutors revealed that someone left $120,000 at the home of a juror Sunday night in an effort to sway her vote. The juror - and another juror who became aware of the bribe attempt - were dismissed, while the remaining jurors were sequestered and the defendants detained for the remainder of deliberations.

The home of one of the defendants, Abdiaziz Shafii Farah, whom prosecutors have described as a ringleader, was raided Wednesday in connection with the bribe investigation.

The defendants are the first to stand trial out of 70 people charged so far in what's been dubbed the Feeding Our Future case - named for a nonprofit at the center of the scheme — and which revolves around a web of people who federal prosecutors say stole some $250 million.

Eighteen people have pleaded guilty and one fled the country.

The verdict is sure to affect the 44 others awaiting trial. More could still be charged, especially if the guilty verdicts unleash a wave of cooperation with the investigation, as defendants and suspects seek lighter sentences. The two acquittals may give some the confidence to go to trial.

This guy wrote a 25 line Python script he claims "can probably unredact all of the Epstein files in less than 30 seconds".

"I am not suicidal, I am a great swimmer, and I look forward to living my life well into my 80s."

Follow @RealWideAwakeMedia for more content like this!

Merch: https://wideawake.clothing

X | YT | IG | Rumble

US / Iranian Conflict

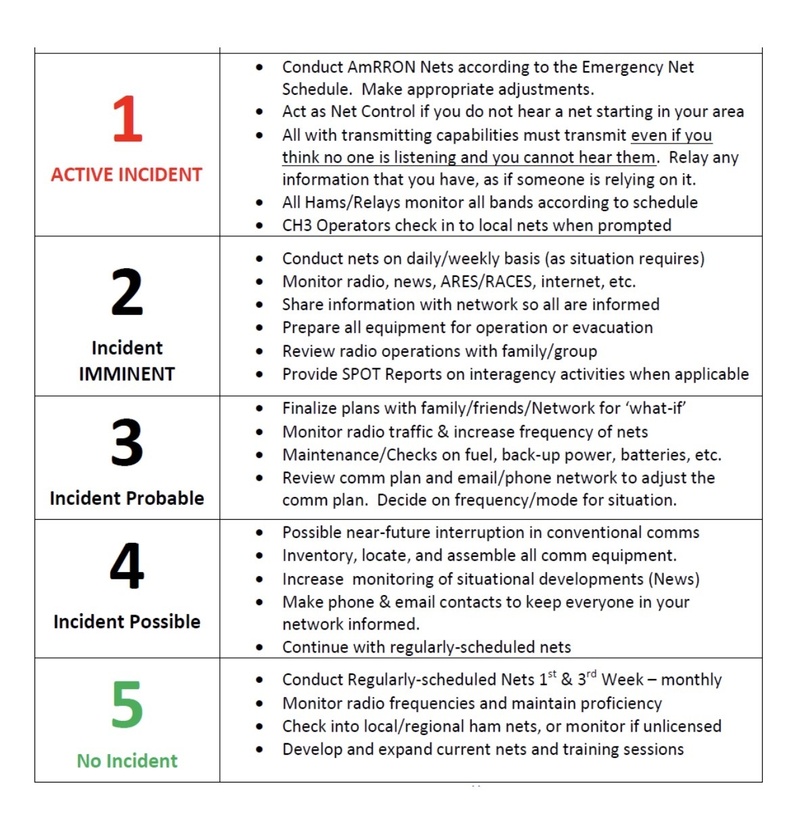

Raising to AmCON 3 (Incident Probable)

Due to the following: deteriorating negotiations between the United States and Iran; the surge in the past 48 hours of “final stage” US military assets into the Middle East; vacating US personnel from bases in Syria; the “Fatwa” issued last summer by Iranian clerics in the Summer of 2025 calling Muslims around the world to rise up if Iran is attacked; the numerous reports of Iranians who have infiltrated the US southern border in recent years and the warnings of “sleeper cells” in the United States, AmRRON is raising the AmCON one level, to Level 3 (Incident Probable).

AmRRON Special Guidance and Instructions:

AmRRON will remain at AmCON 3 until further notice, and we will continuously be monitoring the situation. Additional changes to the AmCON level, and any special instructions or guidance, will be posted here, as well as through the AmRRON member Telegram Channel, the AmRRON Corps Z-Net, and the AmRRON Mobile Team App....

If you’re a parent, this should make your stomach drop!

Every year, millions of families across America proudly display school photos of their children.

On refrigerators. In picture frames. Sent to grandparents and relatives across the country.

But here’s what most parents are never told…

Those school photos are taken by Lifetouch — the largest school photography company in America.

Lifetouch is owned by Shutterfly.

Shutterfly was acquired by Apollo Global Management.

And Apollo Global Management was co-founded by Leon Black — a name that appears in the Epstein files.

That means millions of children’s images are uploaded into databases every single year by a corporate structure tied to someone connected to Epstein.

Let that sink in!

https://vxtwitter.com/i/status/2019500982997041332