We know what’s coming and we are prepared.

🇮🇳 Indian citizen, Bankim Brahmbhatt scammed BlackRock and BNP Paribas out of 552.6 million $ to fund a fake private equity fund, Carriox Capital

Brahmbhatt ran Carriox Capital, a New York telecom financing outfit that convinced BlackRock's HPS Investment Partners and BNP Paribas to lend him $552.6 million. The entire deal was built on one claim: he had legitimate receivables from T-Mobile, Telstra, BICS, Telecom Italia Sparkle, and Taiwan Mobile backing the loans.

None of it was real. Brahmbhatt forged contracts that appeared to be signed by representatives from these carriers. He created fake invoices supposedly issued by these companies claiming they owed Carriox money. Then he spoofed email addresses mimicking these carriers' real domains and sent fake verification emails to make the receivables look legitimate. By stacking these fabricated invoices on top of each other, he created what looked like $500+ million in collateral. The lenders saw assets and funded the deal without catching any of it.

Here's where it gets embarrassing. When HPS and BNP Paribas finally tried to verify these receivables by actually calling T-Mobile, the carrier said they had no idea what Carriox was talking about. No contracts. No invoices. Nothing existed. One phone call would have instantly revealed the entire fraud. These are supposed to be institutional-grade lenders with world-class risk management. Yet somehow they missed basic due diligence.

While all this was happening, Brahmbhatt's people were also stealing cash. Whenever payments came through the lender-controlled collection accounts, instead of applying those funds to the debt, they diverted the money offshore. So he wasn't just fabricating collateral. He was stealing actual cash flows in real time.

Lenders sued in August 2025 and froze all assets. Carriox filed for Chapter 11 bankruptcy with $500 million to $1 billion in liabilities and basically zero assets remaining. HPS is sitting on $552.6 million in losses with nothing to recover against.

The kicker is BlackRock acquired HPS for $12 billion in July 2025 specifically to expand into private credit and get access to its $148 billion platform. Within 90 days of closing that deal, they're holding a half-billion dollar fraud loss on receivables that HPS supposedly vetted and monitored.

That's not just a bad deal. That's a massive question mark about whether one of the world's largest asset managers actually has the infrastructure to verify complex collateral in modern lending markets. If BlackRock's $12 trillion asset management machine can miss $500+ million in forged documents and fake invoices, what else are they missing? This is the systemic risk that should concern everyone.

🔗 Stock Market News

This guy wrote a 25 line Python script he claims "can probably unredact all of the Epstein files in less than 30 seconds".

"I am not suicidal, I am a great swimmer, and I look forward to living my life well into my 80s."

Follow @RealWideAwakeMedia for more content like this!

Merch: https://wideawake.clothing

X | YT | IG | Rumble

US / Iranian Conflict

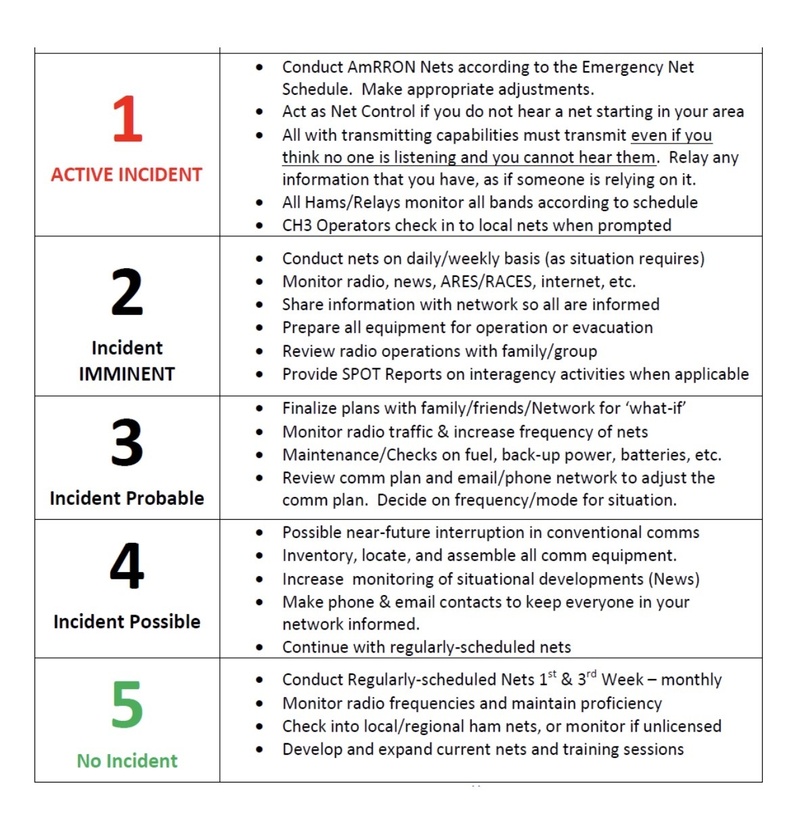

Raising to AmCON 3 (Incident Probable)

Due to the following: deteriorating negotiations between the United States and Iran; the surge in the past 48 hours of “final stage” US military assets into the Middle East; vacating US personnel from bases in Syria; the “Fatwa” issued last summer by Iranian clerics in the Summer of 2025 calling Muslims around the world to rise up if Iran is attacked; the numerous reports of Iranians who have infiltrated the US southern border in recent years and the warnings of “sleeper cells” in the United States, AmRRON is raising the AmCON one level, to Level 3 (Incident Probable).

AmRRON Special Guidance and Instructions:

AmRRON will remain at AmCON 3 until further notice, and we will continuously be monitoring the situation. Additional changes to the AmCON level, and any special instructions or guidance, will be posted here, as well as through the AmRRON member Telegram Channel, the AmRRON Corps Z-Net, and the AmRRON Mobile Team App....

If you’re a parent, this should make your stomach drop!

Every year, millions of families across America proudly display school photos of their children.

On refrigerators. In picture frames. Sent to grandparents and relatives across the country.

But here’s what most parents are never told…

Those school photos are taken by Lifetouch — the largest school photography company in America.

Lifetouch is owned by Shutterfly.

Shutterfly was acquired by Apollo Global Management.

And Apollo Global Management was co-founded by Leon Black — a name that appears in the Epstein files.

That means millions of children’s images are uploaded into databases every single year by a corporate structure tied to someone connected to Epstein.

Let that sink in!

https://vxtwitter.com/i/status/2019500982997041332